“We are sleepwalking toward a climate catastrophe,” said UN Chief António Guterres at the COP26 World Leaders Summit in 2021. And a critical role in addressing the catastrophe relies on businesses and corporations. They need to look past the Friedman doctrine of maximizing profits for shareholders to balancing value creation and sustainability - which is where we believe the financial services industry has a significant role to play.

Here is why – the industry / ecosystem is uniquely placed to be an enabler, a mediator, an investor or a ratings assessor. The real challenge and opportunity is in becoming a direct contributor or doer. While the footprint of the financial services industry may not be entirely quantifiable yet, there is empirical evidence that it has indeed underwritten Environmental, Social and Corporate Governance (ESG) initiatives while maintaining business equilibrium. The industry is already driving investments towards sustainable initiatives through ESG-focused funds, which is projected to be one-third of all global assets.

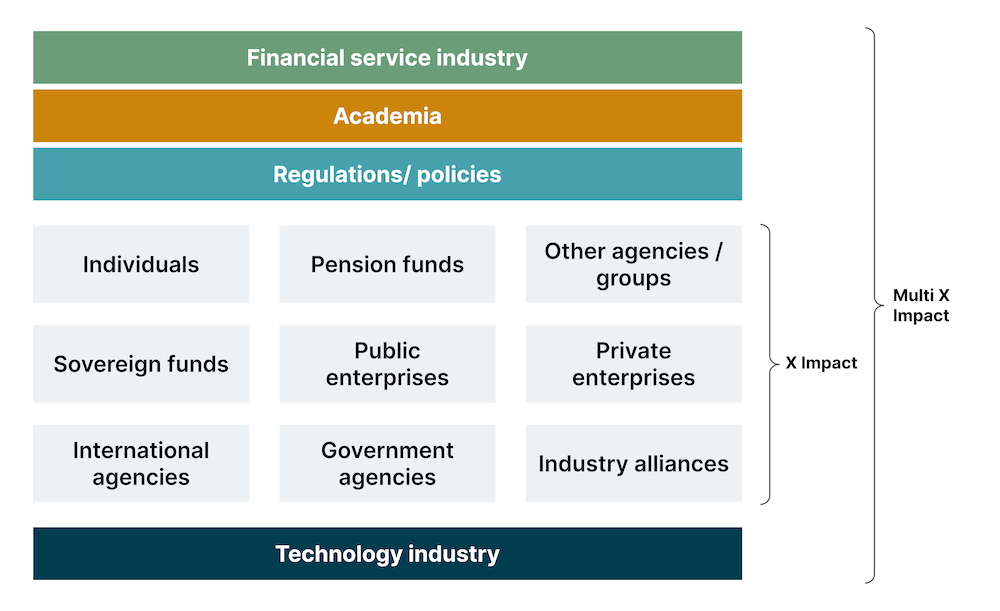

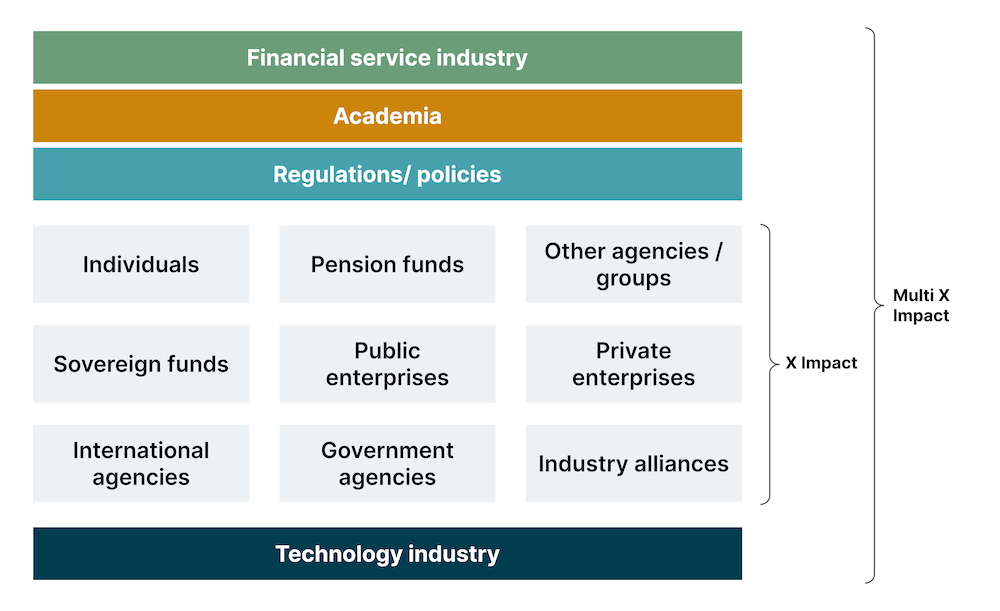

However, no single entity, be it the government or corporate, can tackle the environmental challenges to create the needed impact all by themselves. What the world needs today is different organizations and industries coming together to create a force multiplier effect. Technology and data can further amplify such impact by becoming the connective fabric and providing insights and transparency while measuring outcomes.

Sustainability, while conceptually simple to understand needs a multidimensional understanding of impact space as well as an interdisciplinary approach to creating a force multiplier impact

This blog explores how financial institutions are impacting the 4 pillars of sustainability: humanity, society, environment and economy. Our framework maps sustainability to innovations in financial services which impact businesses in a balanced manner.

Human sustainability

Definition: maintain and improve human capital in society through investments in health and education systems, access to services, nutrition, knowledge and skills etc.

Sustainability oriented innovation: microcredits, health insurance through banks, youth saving groups

Human sustainability by: ensuring equitable access to education, housing, healthcare

Business impact: $6.4bn liquidity provided by regulators in India in 2021 for banks to lend to healthcare sector

Social sustainability

Definition: preserve social capital by investing and creating services that constitute the framework of our society

Sustainability oriented innovation: digital payments, BNPL models

Social sustainability by: ensuring financial inclusion

Business impact: Nigeria's Buy Now Pay Later (BNPL) market estimated to grow from $950mn to $28bn billion by 2028

Environmental sustainability

Definition: improve human welfare through protection of natural capital like land, air, water, minerals etc.

Sustainability oriented innovation: market place for carbon credits, sustainability measures and accounting standards

Environmental sustainability by: facilitating balance between damage and restoration more effectively across locations

Business impact: the global carbon credit market was valued at $211.5 bn in 2019 and is expected to reach $2,407.8 bn by 2027

Economic sustainability

Definition: is the efficient use of assets to maintain company profitability over time

Sustainability oriented innovation: retailing impact investments and green products

Economic sustainability by: ensuring access to retail investors – expanding the investor base

Business impact: $12.85 bn on CSR (7 years) vs. $6.11 bn of green bonds issued in 2021 in India

Human sustainability - carrying the nexus

The Consultative Group to Assist the Poor (CGAP) observed that climate change is not only contributing to migration and urbanization but also exposing many homes to weather related stress and a lack of energy and drinking water. Together, compassionate individuals, technology and governmental financial networks can build the right solution.

Across developing countries, digital financial services are enabling governments to enhance reach, quality and efficiency of publicly provided services. The Reserve Bank of India’s new policy that incentivizes banks to lend to a wider range of entities such as manufacturers and suppliers of vaccines, oxygen and ventilators increased liquidity for healthcare providers by upto $6.4 bn, leading to better penetration and overall outcomes.

Financial services also have significant opportunities to enable education of the youth. Many youg people join savings groups to mobilize savings and loans for their own or their siblings’ educational needs. Resources and skill development alinged with such initiatives comes from the financial industry. For instance, Barclays and Plan-UK’s Banking on Change initiative is a prime example of the same.

Social sustainability - innovating via technology

Today, 1.6 billion adults across the globe are unbanked and many more are under-banked. By harnessing emerging technologies, fintechs are boosting financial inclusion. Replacing cash with digital transactions has moved the needle on sustainability goals – virtual cards reduce plastic/metal use while lower cost fintech solutions further financial inclusion at scale.

For example, analytics help with loan approvals for the unbanked and people with no credit history through business models such as Buy Now Pay Later (BNPL). Nigeria, the largest economy of Africa has a credit card penetration of 3% which is significantly lower than other economies such as Canada (83%), Japan (68%) or the US (66%). With mobile and internet penetration being close to 50%, BNPL models are making headway in economies like Nigeria, facilitating access to small amounts of credit.

Environmental sustainability - financializing the environment

Banks invest in new biodiversity projects, while also trying to reduce the impact of their existing revenue models. De Volksbank, Netherlands aimed to reduce CO2 losses by rolling out consultations to educate customers about their energy saving options and home insulation. Banks, worldwide, are aligning their lending and investment portfolios to ensure net-zero emissions by 2050.

Financial Institutions have even facilitated a marketplace of such activities. For example, enabling carbon production (such as industrial emissions) in one location and renewing / storage in another (e.g. rainforests) thus, creating a marketplace where such activities are offset against each other.

While 'emissions marketplaces' are critiqued for being 'profit accumulating tactics' that will not sustain nature, initiatives like carbon credit trading are instrumental in ensuring net-off and overall sustainability. When combined with economic sustainability, we see financial institutions rallying resources to save important resources.

Economic sustainability - retailing the playbook

Impact investment used to be a niche terrain with specialist players and beneficiaries. That’s no longer the case. The Supranationals European Investment Bank (2007) and World Bank Group (2008) issued the first green bonds, with a commitment to invest the proceeds in environmentally-friendly projects. Several financial institutions have since followed suit, enabling environmentally-minded investors to partake in causes they believe in.

To understand the impact, lets review sustainability funding sans bonds. Most non-material industry firms adopt compensatory strategies such as planting trees to match their consumption of energy. Budget for these comes from the CSR bucket too. For instance, India Inc spent $12.85 bn on CSR over the last 7 years ending March 2022. Contrast this with India issuing $6.11 bn in green bonds during the first 11 months of 2021 alone!

While the opportunity around ESG is growing, so are the concerns regarding Greenwashing. To add to this, during the current market slump, we saw investors withdraw $2 billion from ESG-labeled exchange-traded equity funds, which also shines a light on whether investors are staying committed to ESG initiatives irrespective of market cycles.

To successfully overcome these challenges and continue to build sustainability initiatives, organizations need a considered and long-term strategy.

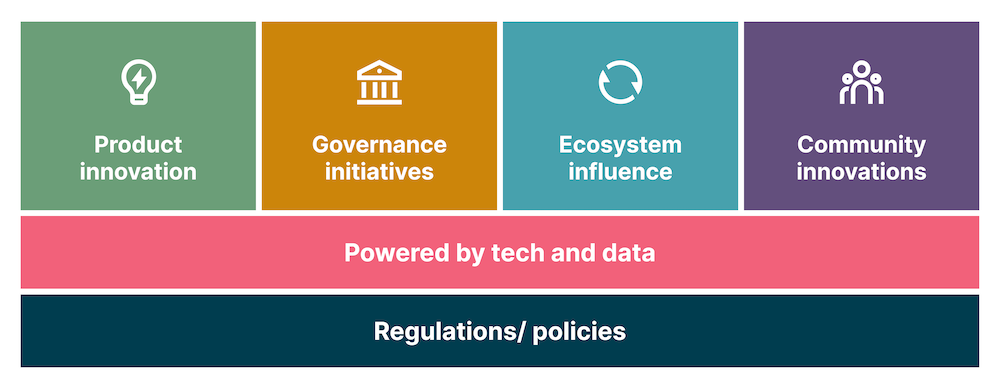

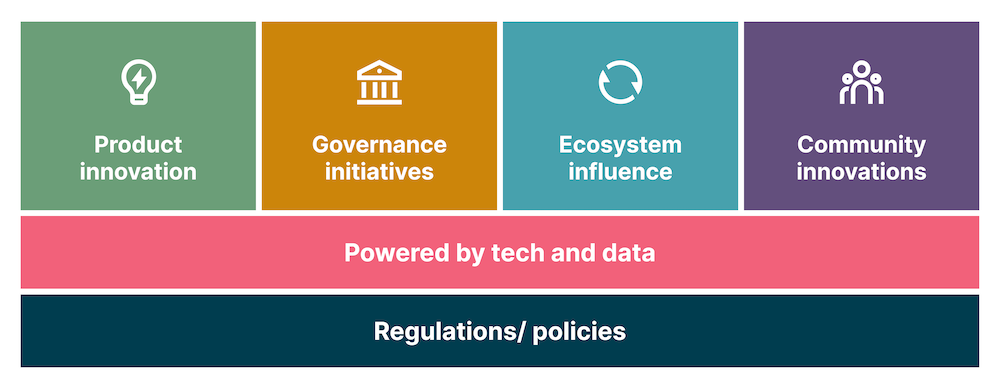

Here's how financial services organizations can adapt their services for sustainability, powered by tech:

We believe that organizations need to combine product innovation, governance, ecosystem influence and community innovations, powered by tech and data and built on the foundation of regulation.

Product innovation: there is a rise in innovative products such as Donor Advised Funds, that provides incentive, purpose and control to customers. This helps channel funds towards sustainable development activities via charity / gift initiatives.

Governance: to balance sustainability and growth, financial institutions like Credit Suisse have created risk management approaches. Many others are setting up advisory groups that directly report to the board to make sustainability a priority.

Ecosystem influence: organizations like JP Morgan are setting carbon intensity targets for key sectors in their financial portfolio. This encourages their corporate clients to consider sustainability as part of their own business strategies.

Community influence: organizations like Thoughtworks that have sustainability as part of their core strategy are creating playbooks to help clients embark on their sustainable development journey and make an impact on several interconnected sustainable development goals.

Technology and data: organizations need to collect, understand, analyze and tie non-financial data back to financial outcomes. Appropriate data platforms and ecosystem models will make this approach easier. Also, making these technologies open source will ensure the data is equitable and available for anyone to build on.

Policy: ISSB and EFRAG’s work on EU sustainability reporting are bringing uniform standards for sustainability disclosures.

Our recommendation is to focus on sustainability through five focus areas:

Responsible tech and innovation

Evaluating the risks and social implications of tech, embedding the values of privacy, empathy, equity and inclusion in tech solutions

Extending opportunities to increase the advancement of underrepresented groups in the technology sector

Inclusivity and social justice

Using data to highlight injustice and using technology to provide platforms for empowerment

Developing tech based approaches to extend health information and care to communities grappling with health service shortages

Sustainability and climate action

Leveraging technology to identify and mitigate the negative impacts of climate change and reduce carbon footprint

To create a sustainable future, business strategy needs to steer organizations to achieve profit from purpose. Leveraging technology will help gather accurate data and glean insights on how organizations' contributions are creating a real impact.

Talk to us, if you’re interested in knowing how tech can help your organization achieve and contribute towards making our world a better place. We also encourage you to read our social change report; Tech @ Core of the Society.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.