Summary

Contemporary business models, maturing technologies, lean architecture and big platform players have brought us to a fascinating time in the banking industry. New market entrants compete directly with banks via challenger or neo-bank offerings, in addition to the digital-only side bet offerings from incumbent banks.

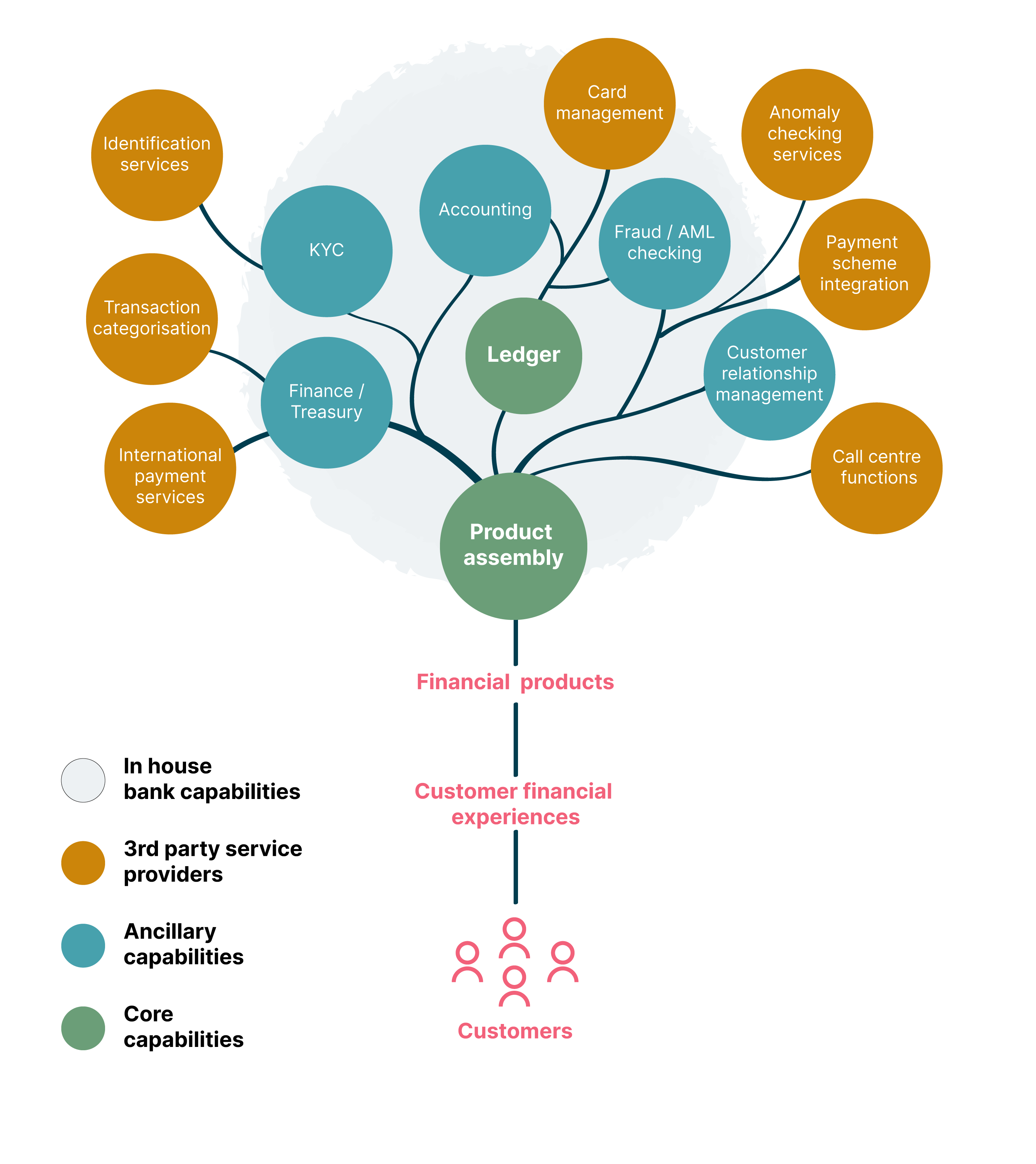

Every part of the banking value chain can now be serviced in some way by a non-banking service provider. Fintechs are keen to get a piece of the lucrative revenue pie that banks have traditionally entirely consumed. Banks are realizing that digital journeys don’t end with the purchase and deployment of a single core banking solution. The anatomy of banking is changing, and it is likely to be an ecosystem of parts rather than a single product. Those parts are less likely to all come from a single vendor. Change as a constant will be the new normal and core systems play an altered role.

What is the problem?

To face the unpredictability of economic headwinds in the industry, most banking CIOs are embracing legacy modernization, accelerating digital transformation and increasing digitalization of products and services. However, executives are finding this to be a difficult challenge due to the limitations of their core architectures and their relatively slow pace of change. The more digital a bank wants to become, the deeper it needs to dig into the architecture stack and workflow to change it. This situation is exposing the limitations of banks’ current anatomy. As a result, CIOs today have started to define the ‘New Age Anatomy’ for their bank by reviewing their core banking solutions (CBSs).

Over time, core banking solutions have established a reputation for being massively expensive, slow and painful to roll out and excessively brittle when it comes to performing change. They were designed for longevity and stability. Redesign and innovation was likely smothered by fears of risk-taking or by habitual executives that have always done it that way. In short, the solution was ripe for disruption and overhaul.

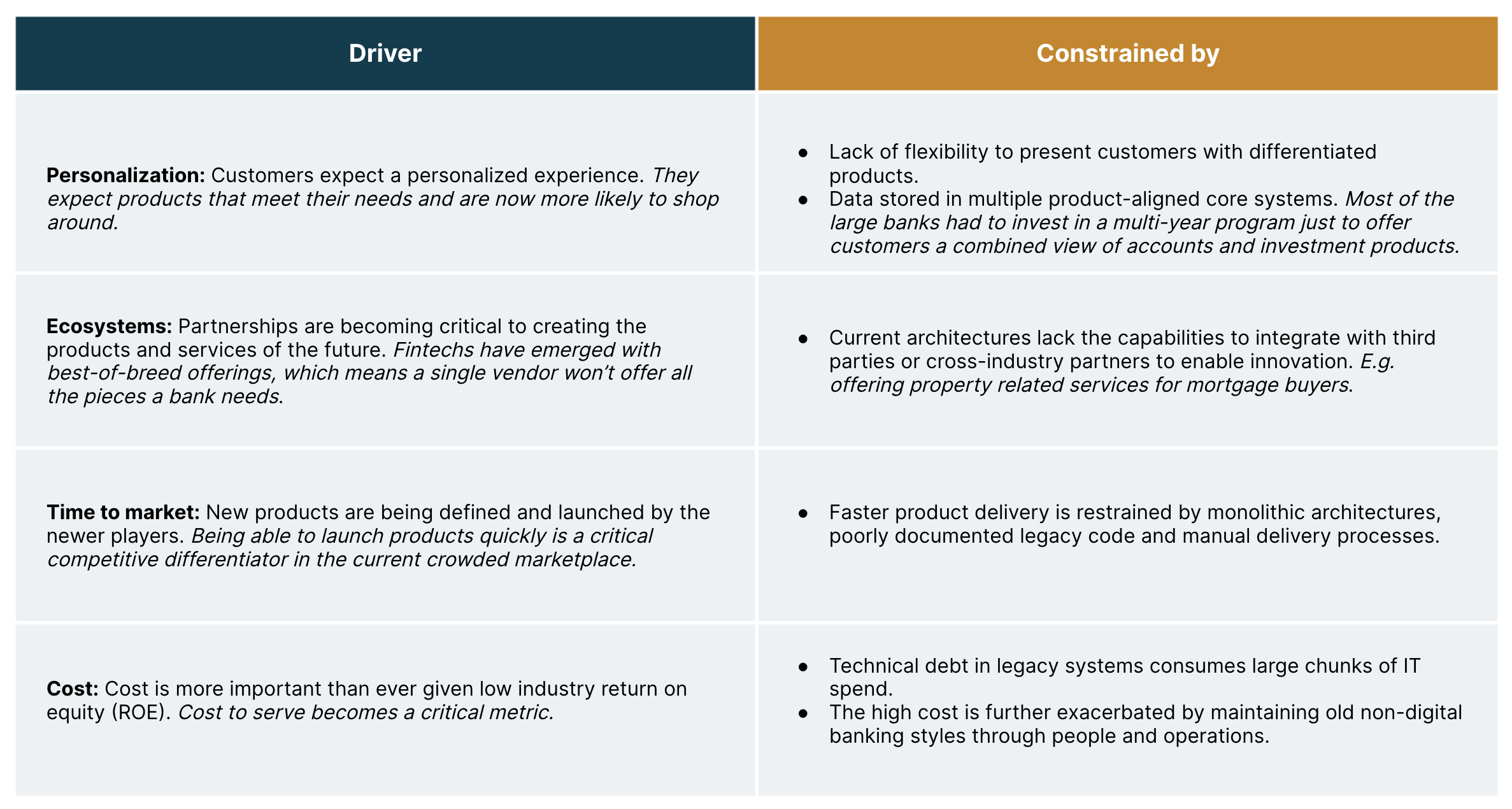

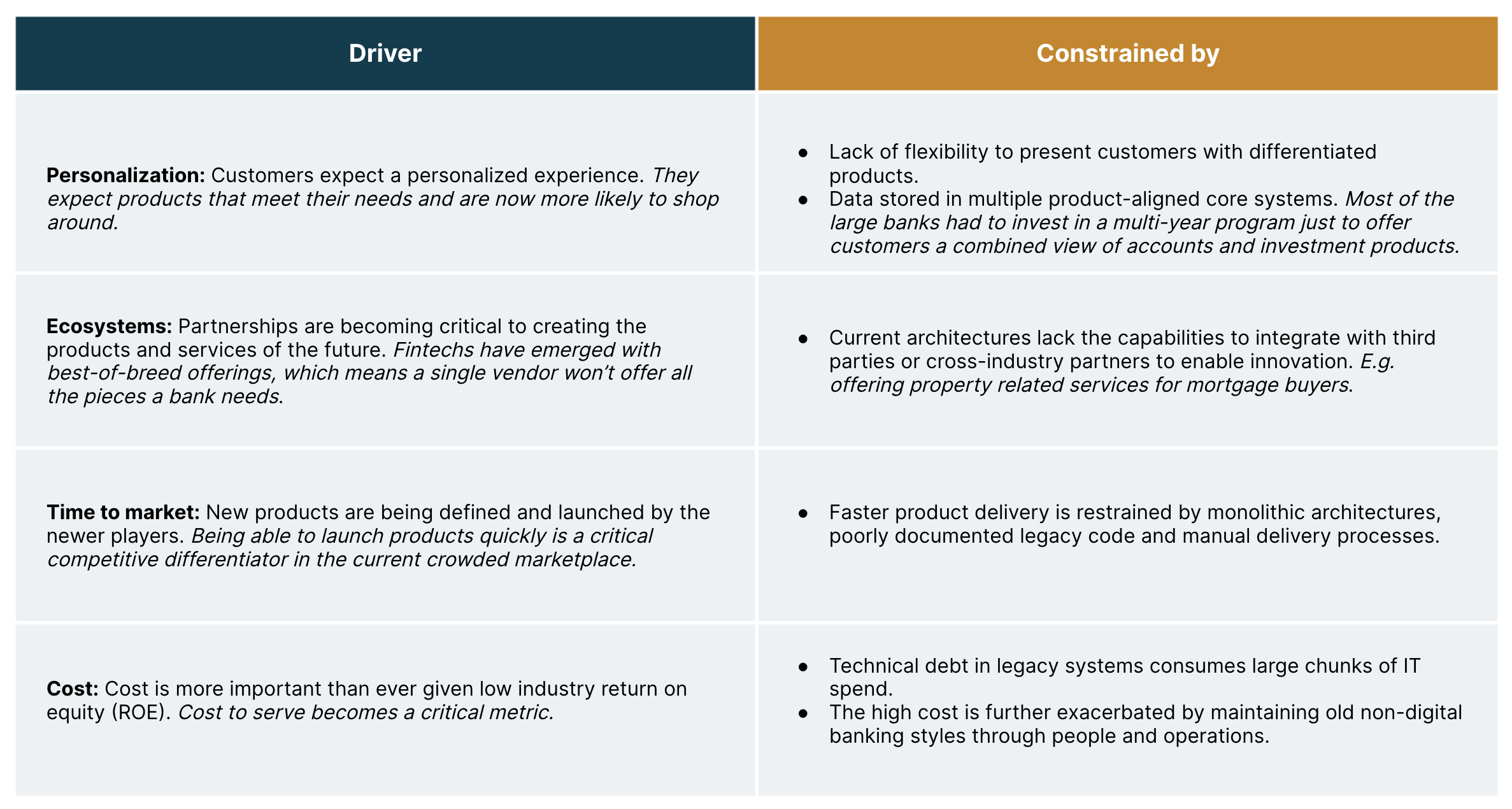

First let’s understand the key drivers for change and tie that to the constraints in the legacy solutions:

Understanding the new anatomy

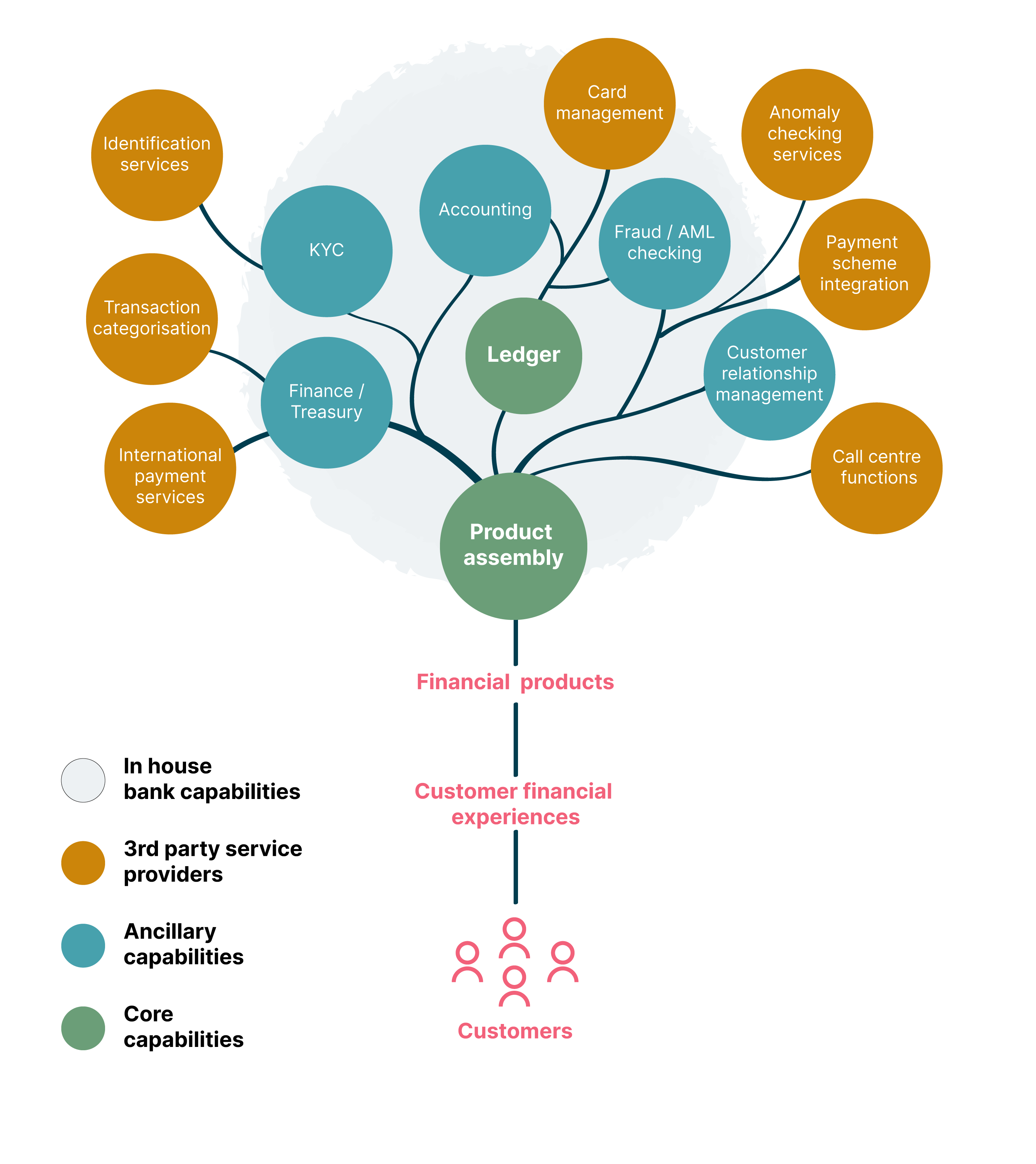

CBS will remain at the center of the new banking ecosystem anatomy. However, simplification will result in a reduced footprint of the core but with a more concise set of responsibilities to build a modern composable banking ecosystem. As part of the anatomical shift, banking executives now look for best of breed solutions with multiple components. This is delivered through small component-based architecture, functional granularity, interoperability and internationality based on cloud-native technologies. This enables on-demand computing, unbridled scaling opportunities, lower run cost, automation and resilience. We see that the following five fundamental determinants in any modern core will help CIOs of the bank to set their direction:

Continuous delivery - supporting change rather than looking for longevity and stability

Autonomous cloud native components with clearly defined boundaries - designed to plug in and scale on demand with the needs of the bank

Microservices and APIs architecture - to enable faster integration whilst building up the needed ecosystem.

Flexible product ranges - enabling shorter time to market and ultra-personalization without vendor dependencies

Real-time data analytics - to deliver a single source of truth for customer and transaction data

The above theory leaves space for other components and systems to fulfill the major functions of banking operating units. In the new architecture, the use of third party services becomes essential, which encourages an ecosystem to leverage best-of-breed solutions with ease of switching in the future.

Based on our experiences, the new age bank anatomy will address the constraints through:

Customer-centricity

Personalized experiences and constantly evolving products will meet customer needs and keep up with competition whilst also allowing the bank to experiment. This aims to deter customers from looking elsewhere.

Escalating data proposition

Data capabilities are now a critical differentiator. Modern platforms support integrated data sets and a single source of truth. Event streams create the ability in real-time to offer personalized experiences and run advanced analytics for sharper decision-making (e.g. for front-line staff).

The ability to scale through partnerships and innovate

New platforms enable rapid scaling and less expensive development of ecosystems and ancillary services. Integration is easier with modular architectures and communication via APIs. Developer experience can no longer be ignored and becomes critical to nurturing an ecosystem.

Accelerated time to market

Banks can more efficiently develop new products and services, aided by product flexibility. Higher levels of standardization and modern technology make it simpler to leverage product pipelines that incorporate automated testing and frequent deployments. This means deploying many times per day rather than big bang releases separated by months.

Reduced IT costs

Banks can cut spending through higher developer productivity and the removal of technical debt. They can achieve further efficiencies by leveraging cloud-based services (which enable them to deploy new products and scale infrastructure quickly) and by using development tools that support automation (DevSecOps).

Getting there

There is a decision-making path to identifying the types of products and solutions that need to be procured and sometimes built. Before that, CIOs need to assess the following decision making principles:

Invest in the differentiators for your business. Free up resources to allow you to make more ‘bets’.

Stand on the shoulders of giants. If others are doing things well then it is probably no longer a differentiator for your business. How can you utilize service offerings?

Technology assets gain a clearly defined lifecycle that allows for investment, nurturing and retirement. Do you have a simplified tech model that encourages disposable tech?

Create single purpose components / systems (possibly built or consuming as services) that do what they are supposed to do very well.

Components are effective citizens in your ecosystem facilitating and encouraging integration. Are they governed providers of data and events?

- The composition of your system is driven by repeatable pipelines that allow the building and deployment of the components. How long do changes take to get to production?

- Choreograph business and tech processes rather than orchestrating to provide real time observability.

How to keep it going

The change to a new anatomy does not look for a large capital program or ‘rollout’. Changes are incremental and ongoing. As pieces of the anatomy tire and age they get retired and replaced. This is not a sweeping change to everything, it is an ongoing tuning of the anatomy so that it remains healthy. Continuous nurturing of the new anatomy involves:

Establishing metrics to recognize and embrace constant change as part of a health check.

Measuring the effectiveness of individual components, with a clear view of the domains and supporting components so that responsibilities are effectively allocated.

Monitoring and assessing the industry components that are useful for replacements or additions to the ecosystem.

Introducing additional components, and ensuring there is a clear path to allow low impact experiments with real customers, real products and real data.

Above all, position customers at the centre of the ecosystem and deliver simple but feature-enriched products that they want. There will always be something new and banks need to be equipped to provide this or others will.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.