Prospa, a publicly-listed non-bank lender, has built a market-leading reputation over its decade-long tenure, offering superior lending products to small businesses in Australia and New Zealand. Its remarkable growth is a result of its customer-centric approach, swift and quality credit decisions, and responsible management of investor funding.

Starting in August 2021, Prospa made strategic investments to elevate its products to a level ten times more efficient and effective than the existing market offerings. This ambition laid the groundwork for continuous differentiation from traditional banks and the rapidly expanding spectrum of business lending fintechs.

Consequently, Prospa's core technology underwent considerable enhancements and automation to support the development of future funding products that address the unique cash flow needs of each small business.

Prospa selected Thoughtworks as their technology consultancy partner, capitalizing on Thoughtworks' local and global expertise in rapidly delivering comprehensive business value for financial organizations, all the way to their core technology.

As Darren Mason, Thoughtworks Financial Services Tech Principal puts it, core transformation now requires a more composable approach: “a reduced footprint of the core but with a more concise set of responsibilities to build a modern composable banking ecosystem. As part of the anatomical shift, banking executives now look for best of breed solutions with multiple components.”

Thoughtworks was the ideal strategic partner for Prospa, easily aligning with our ambitious growth efforts. We sought more than just a service provider; we needed a genuine partner that could catalyze our initiatives. Thoughtworks has proven to be just that.

Our approach

Prospa chose Mambu's core banking platform, drawing confidence from our previous successful implementation of Mambu during the transformation of Bluestone home loans. This successful collaboration earned us the distinction of Mambu APAC Partner of the Year.

The partnership launched with an innovative re-platforming initiative, bringing together a diverse cross-functional team of Prospa and Thoughtworks’ experts in financial services, customer experience, design, product management, and enterprise modernization, platform and cloud. Despite being spread across five locations in Australia and China, the team demonstrated effective remote collaboration throughout the engagement.

In the initial five-week discovery phase, the team clarified business objectives, recognized existing customer and technology challenges, and outlined a future state along with a supporting roadmap.

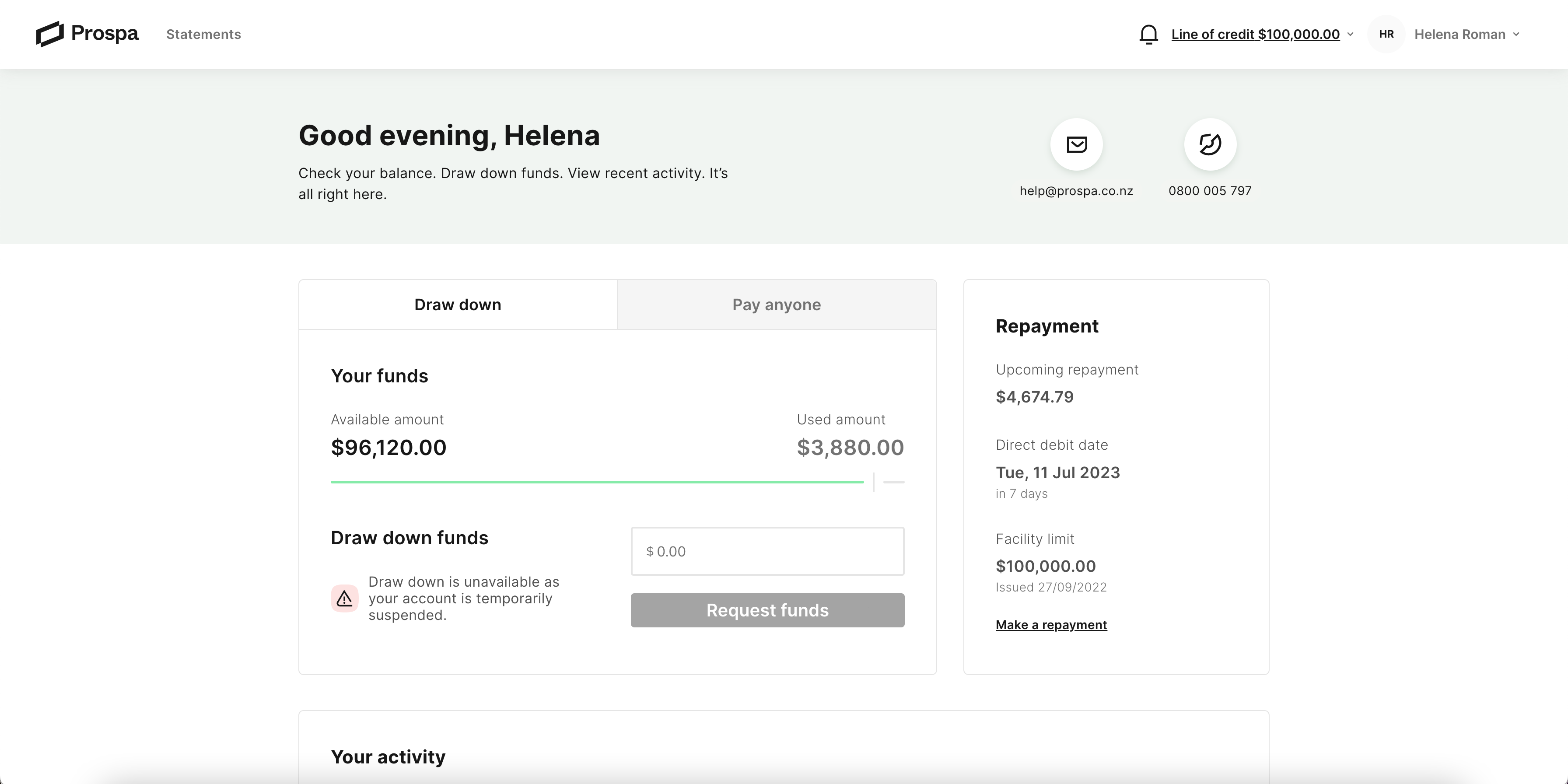

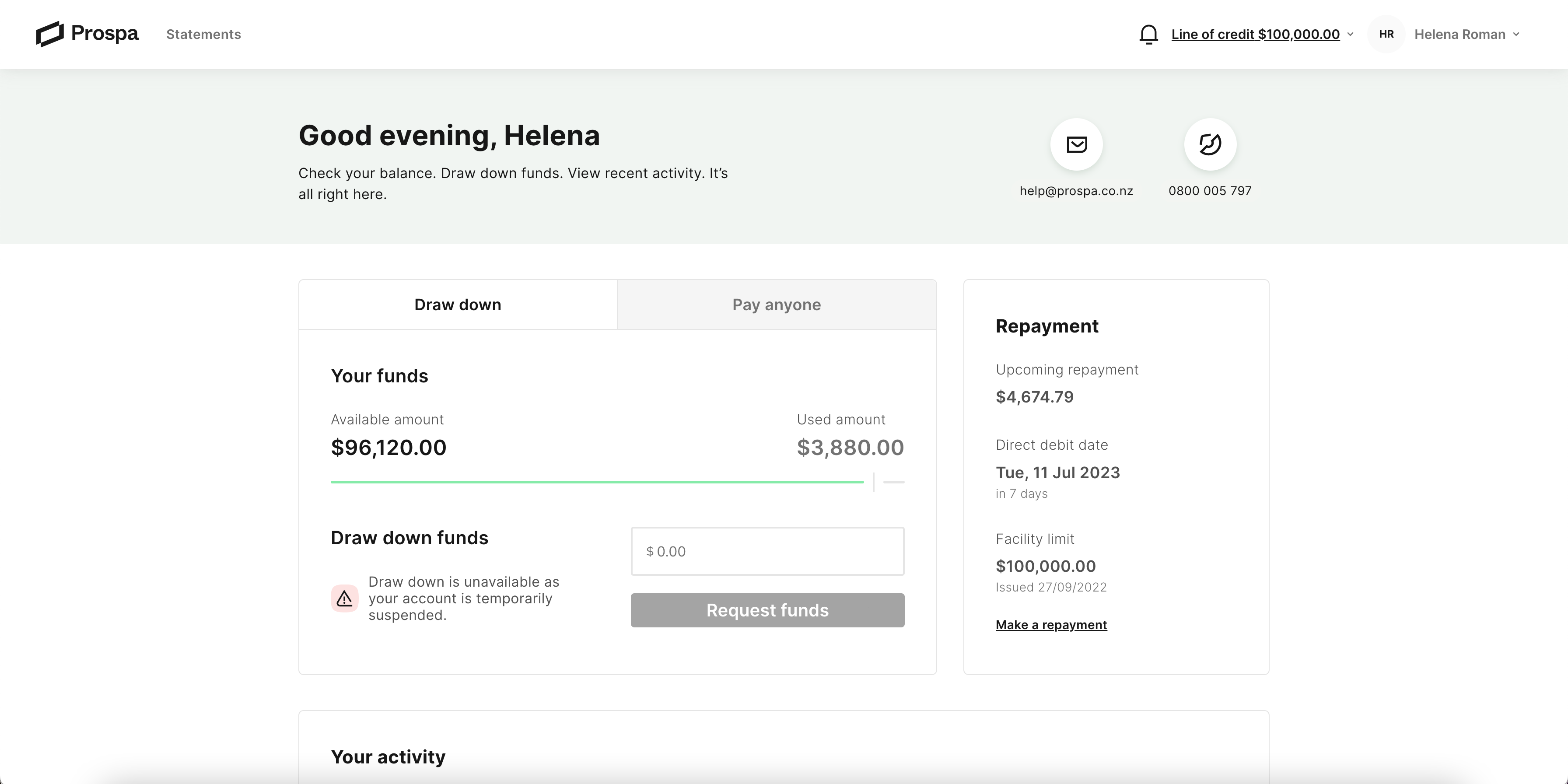

A prominent feature on the roadmap was Prospa's pending Line of Credit (LoC) product for New Zealand. Prospa intentionally delayed its implementation, envisioning it as the pilot product for the newly enhanced platform. With the early 2022 launch in mind, Prospa decided to roll out the LoC to a select group of low-risk, direct channel customers in New Zealand.

Prospa's Line of Credit platform

This strategic step allowed the team to define the initial functionality for a successful launch. The experiences and insights from this pilot will guide the scaling of the product to a wider customer base in both New Zealand and Australia, and aid the smooth transition away from the existing platform.

Within a span of eight months, the joint team successfully implemented an initial phase of platform improvements on Mambu. This allowed the soft launch of a new Line of Credit product, providing New Zealand business owners with flexible, ongoing access to funds.

The Line of Credit product was launched on a composable platform, facilitating Prospa’s ability to integrate or construct best-in-class solutions. This crucial step empowered Prospa to conduct better testing, learning, and adaptation of other business capabilities, effectively mitigating risk. It paved the way for the scaling of products to enhance their offerings and penetrate new markets.

It was quite the bold decision we made back then. To be here now, just eight months from inception, and witness it all come to life is a truly proud moment.

One of the hurdles the team successfully navigated for this initial release was reconciling Mambu's transactions, which were built for a real-time payment system, with the existing infrastructure in New Zealand. The latter did not yet support real-time transactions. In response, the team collaborated to integrate support for multi-day transactions into the ecosystem, effectively resolving this issue.

The Line of Credit's initial phase, targeting existing customers, was met with enthusiastic response from financial advisors, brokers, and small business owners. Reflecting this positive uptake, Prospa New Zealand saw a substantial increase in originations during the fourth quarter of the financial year, registering $39.8 million - a growth of 22% compared to the previous quarter.

Prospa New Zealand saw a substantial increase in originations during the fourth quarter of the financial year, registering $39.8 million - a growth of 22% compared to the previous quarter.

Treasury and finance integrations

Prospa's treasury and finance operations were instrumental in supporting scalability. The team undertook an in-depth discovery process to identify manual processes for loan securitization with investor trusts that could benefit from automation. Upon successful implementation with another vendor, this step enabled us to expand the LoC product in New Zealand to a larger customer base. Moreover, we ensured it complied with Prospa's investor trust reporting requirements without burdening the treasury team with additional complex manual work.

New Zealand Line of Credit product scale release

Backed by the positive feedback from both internal Prospa stakeholders and external customers from the initial New Zealand LoC release, Prospa undertook a scaled market release for LoC in New Zealand in July 2022. This was achieved while simultaneously addressing the demands of supporting a product launch, developing and releasing new features, rectifying bugs, and strategizing for the next product launch.

I've been part of this exercise multiple times. Some of them fail miserably. Banks cannot transform like this. They spend five years and millions of dollars and at one point in time, they just say this is too hard. And we did it in eight months. Just incredible with a team that's actually very small in comparison with other organizations.

Following the successful pilot launch of the Line of Credit in New Zealand, the team turned its focus to integrating Prospa's three flagship products into the new technology stack. With the goal of re-introducing them to the markets in both Australia and New Zealand, they capitalized on the insights gleaned from the pilot launch to optimize the development process.

Leveraging these learnings, the team efficiently streamlined the development and rollout of these three products within a one-year timeframe. The journey from inception to launch showcased the team's agility and commitment to delivering top-tier financial solutions to Prospa's customers.