The financial services industry, especially legacy organizations are said to be recession-proof, i.ie., sturdy enough to tide through an economic downturn without facing devastating impact. However, recent events have proved that even established participants are negatively affected by systemic shocks and events beyond their control. Today, mere survival will not be enough and as financial institutions gravitate toward improving cost efficiency, protecting revenue and managing risk – they are creating the perfect opportunity for disruptors to enter and begin gnawing at the pie.

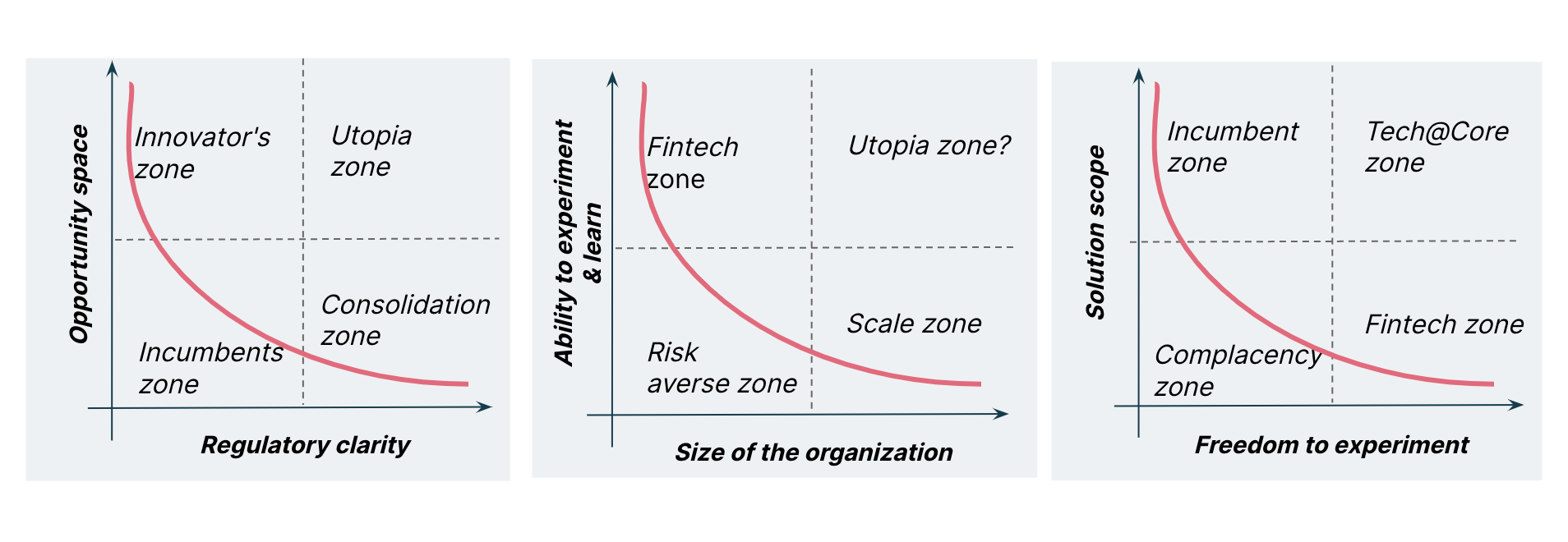

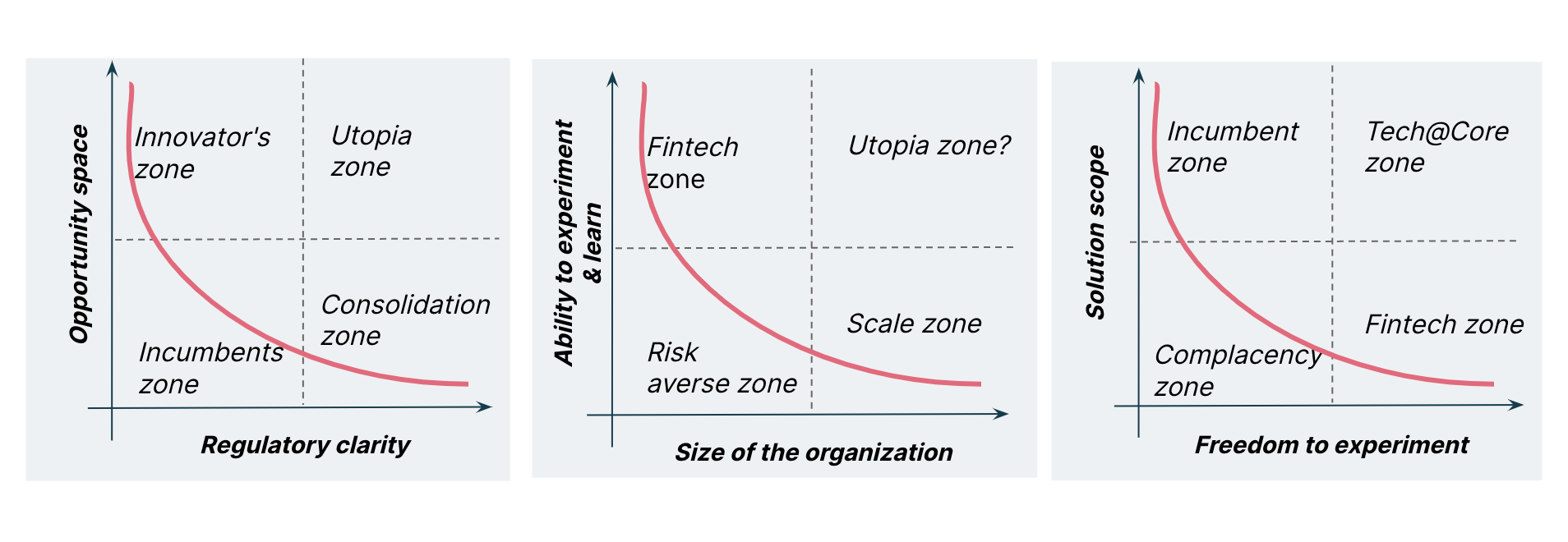

Disrupters or fintech organizations score on three critical metrics: regulatory clarity, organization size and freedom to experiment.

Figure 1: Financial services maturity cycles

Incumbent large financial services organizations tend to wait for regulatory clarity, while fintechs cash in on the opportunity through experimentation. While incumbents look for validation via traditional means, fintechs — naturally smaller — explore multiple models simultaneously, finding successful ideas faster. Lastly, fintechs also needn’t worry about scale because they have fewer rules to follow. As a result, when the downturn passes and the upswing arrives, incumbents would have ceded ground to fintech disruptors involuntarily.

To avoid ceding ground and capitalize on the natural swing of the economy, we believe they need to develop what we call Organizational Plasticity.

Organizational plasticity

Organizational plasticity is inspired by neuroplasticity, the ability of neural networks in the brain to change through growth and reorganization – as a way to adapt to new situations. We believe that through reorientation and reprioritizing, incumbents can achieve organizational plasticity that empowers them to capitalize on the economic upswing. Now is the time to invest in audacious innovation experiments at a judicious scale. In this article, we explore how financial services organizations can achieve that.

Focusing on what matters

Often, incumbents consider net new customers as a key measure during a downturn. What could be a more telling metric is whether the incumbent is the Primary Financial Institution (PFI) for that customer. This demands a fundamental shift from transaction-based customer service to a relationship-based one. Customers, too, expect seamless, simplified and convenient journeys to be table stakes.

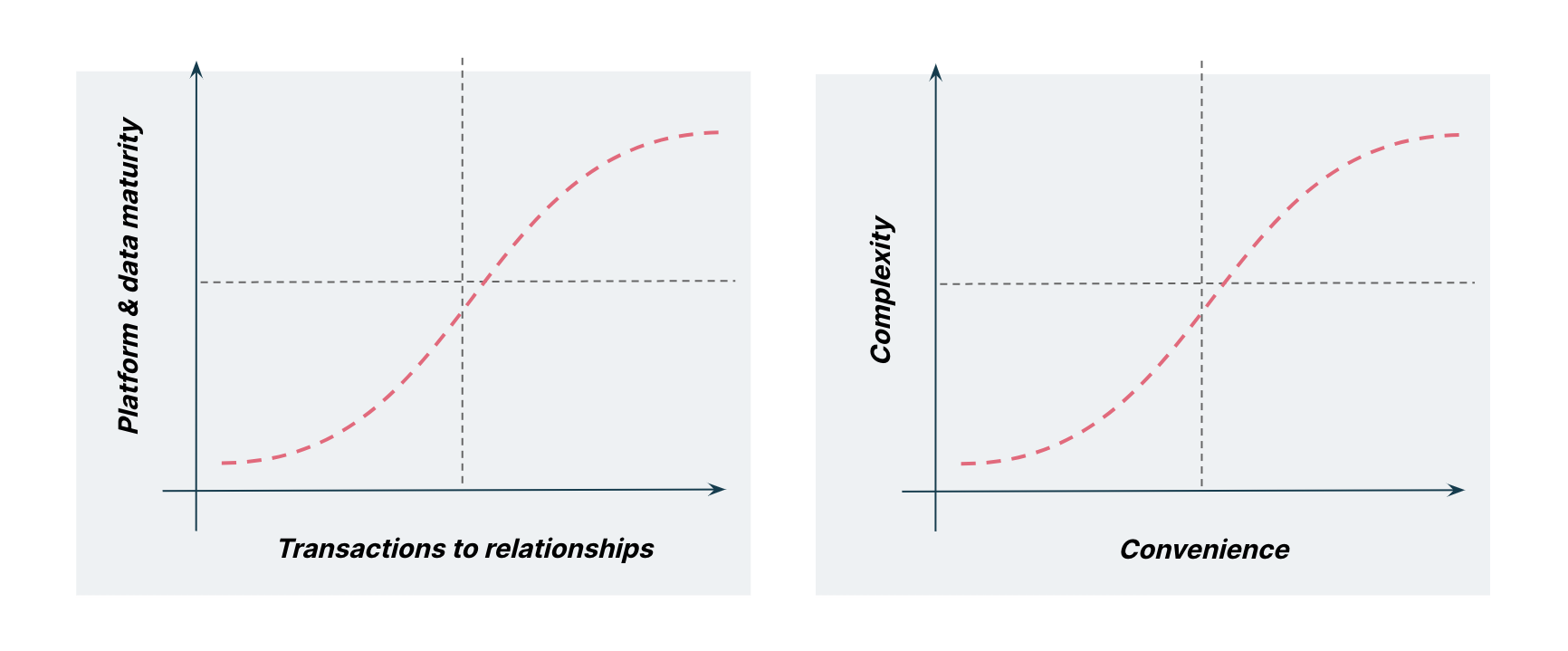

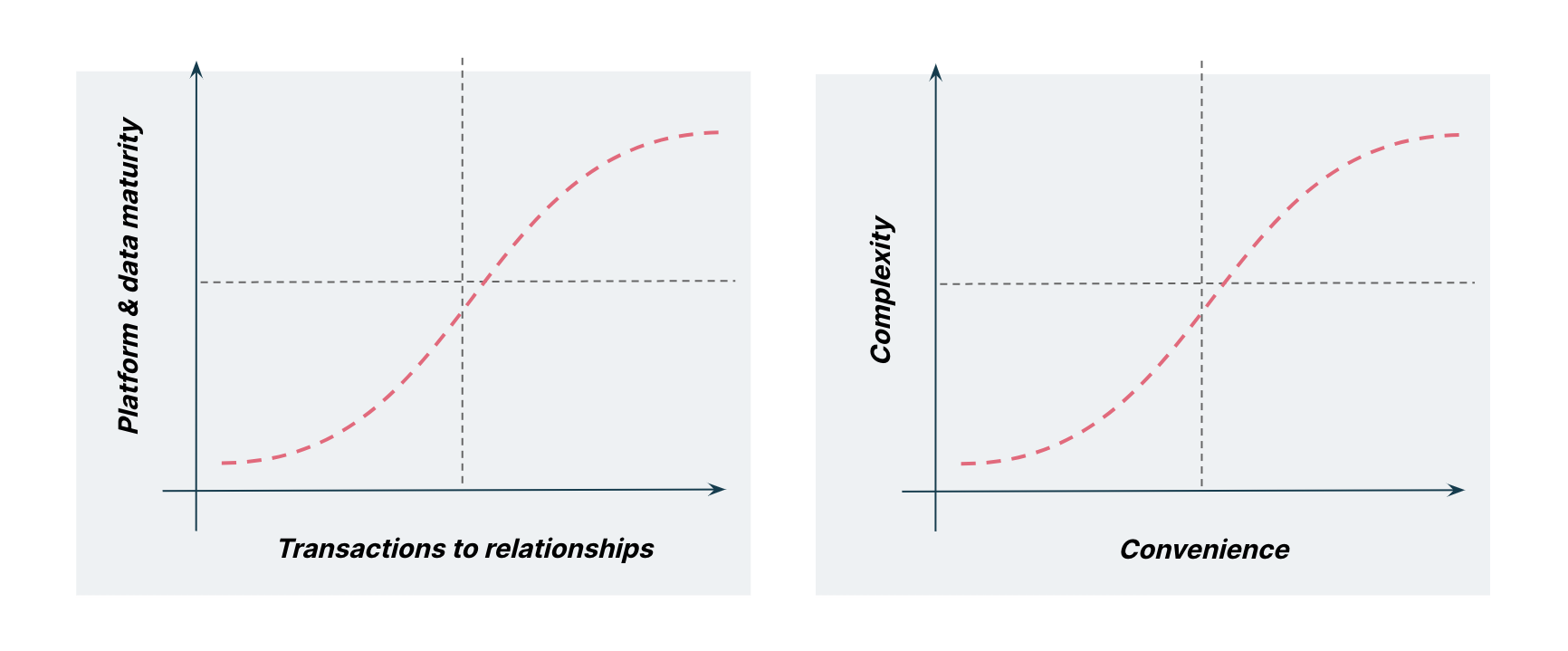

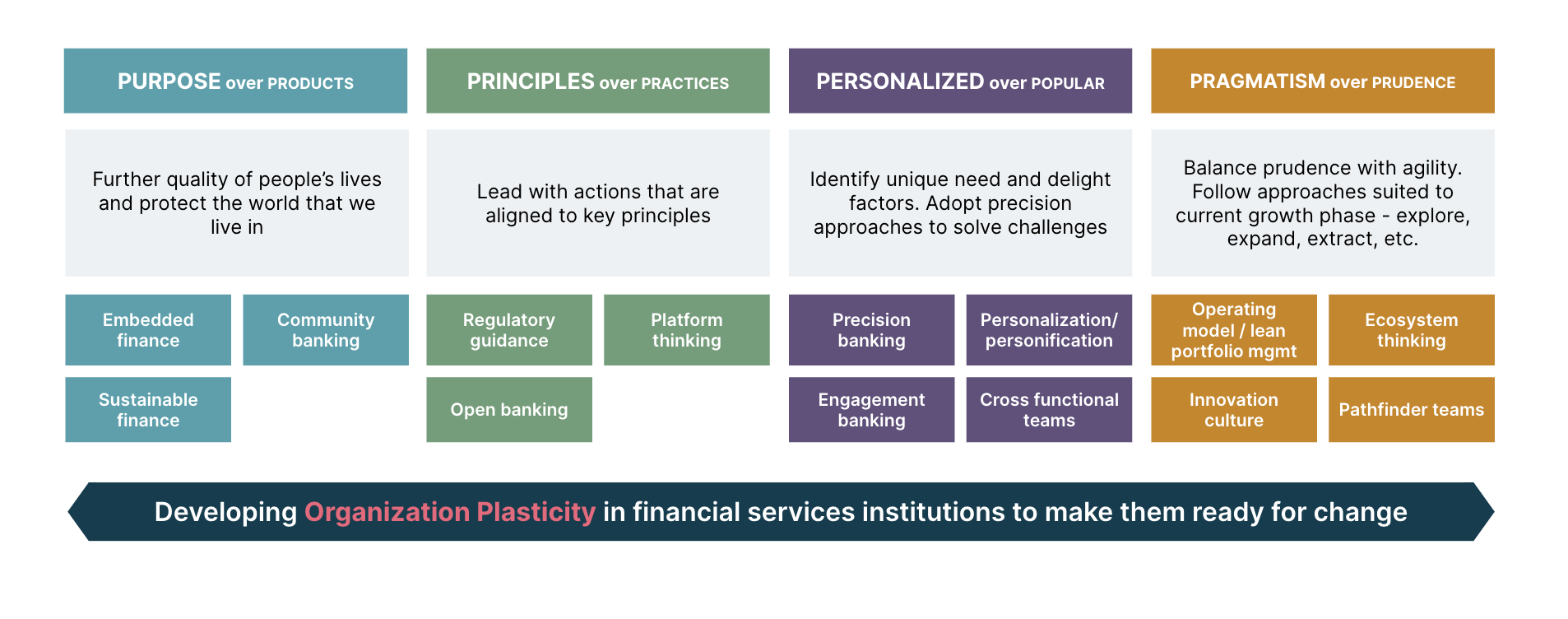

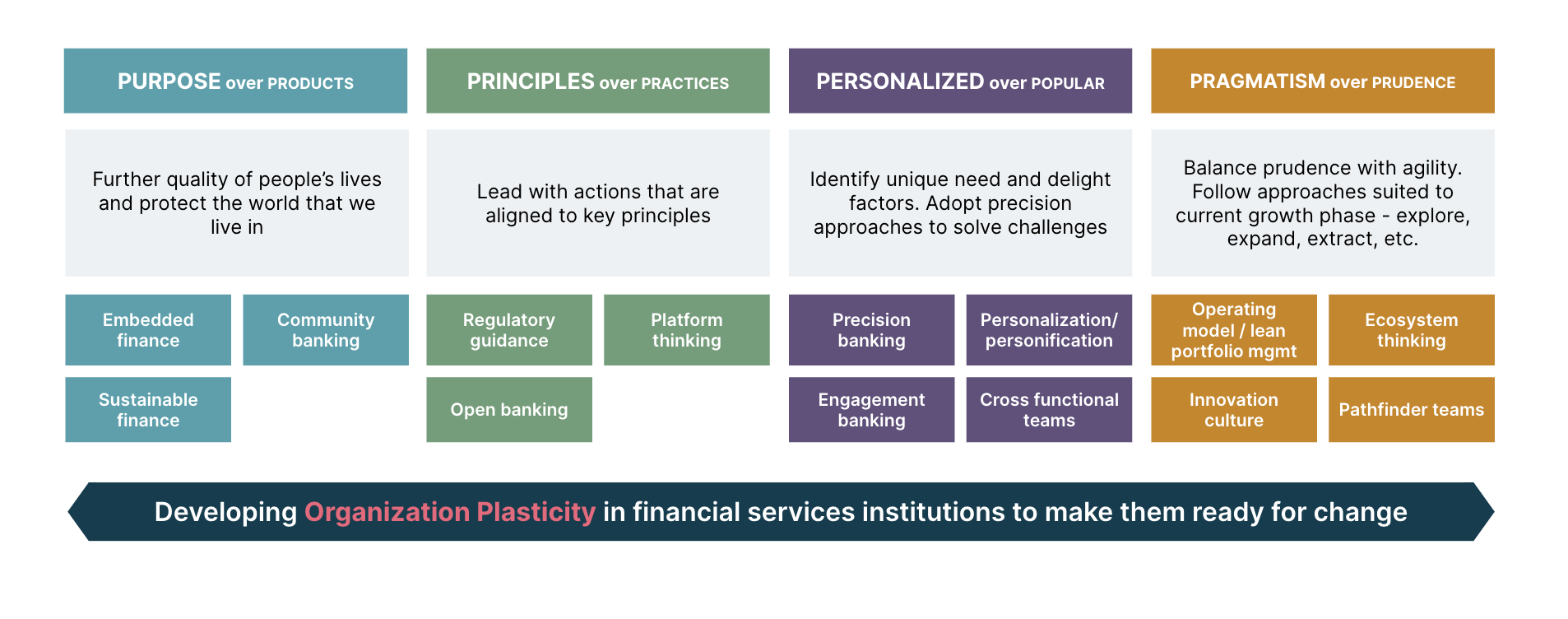

Figure 2: Business prerogatives and technology needs

On the technology front, this needs two things:

Maturity of platforms and data

Ability to support complex experiences and orchestrate dynamic solutions hitherto unexplored

This needs a strategic and sustainable approach to building technology. Based on our experience working with global financial services leaders, we’ve designed the 4Ps model to develop organizational plasticity.

Finding a stable middle ground with the 4Ps model

To develop organizational plasticity, especially through the downturn, incumbent financial institutions need to invest in product and distribution innovation, albeit judiciously. Drawing from Kent Beck’s 3X framework, we recommend the 4Ps model to structure cautious experiments to build organizational plasticity.

The 4Ps model empowers financial services organizations to adapt and evolve based on the changes around them, making new (neural) connections and mimicking the brain’s neuroplasticity.

#1 Purpose over product

Organizations need to create a customer relationship approach that prioritizes addressing a core purpose over selling products. For instance, sales teams must help customers solve a home-buying problem, creating a stellar experience instead of merely selling a loan product.

This can be achieved in many ways. Leaders can lead with strategic clarity (characterized by enabling customer success across all levels) , standing for the customers' best interests. Organizations can embed holistic ecosystem thinking to identify critical gaps in the customer journey. Sustainable finance solutions are especially valuable for Gen Z, who are eager to work only with authentic and responsible brands.

#2 Principles over practices

Operational efficiency depends on rules and guidelines strictly followed across the board. In the highly regulated financial services industry, this approach has worked so far. However, innovation doesn’t happen within borders. To find an innovation sweet spot, incumbents must find ways to embrace their core values and evolve methodologies accordingly instead of blindly following the rule book.

A key example we see here is the adoption of Agile methodologies. Organizations must strive to ‘be agile,’ not ‘do agile.’ This means they must look beyond the specific practices in conducting scrum meetings, sprint planning, or architectural guidelines to embrace the overarching principles closely.

The big opportunity to use this tenet is in Open Banking. By innovating on top of and around current open banking models to create new revenue models, aligning with regulations and customer data protection. They can leverage platform thinking and data monetization approaches to create trailblazing opportunities.

#3 Personalized over popular

While this seems rather obvious, incumbent organizations struggle to achieve personalization, often falling back on audience segmentation in product design. As a result, driven by the fear of missing out (FOMO) and risk avoidance mindset, they end up creating lukewarm products.

We believe now is the best time to invest in product innovation. For example, precision banking, i.e., creating products for a segment of one, can provide a significant first-mover advantage to incumbents. Experiments in cross-functional approaches, personalization, personification etc., can help identify unique offerings that can be piloted during the downturn and prepared for scale when the upswing arrives.

#4 Pragmatism over prudence

During a downturn, incumbents reach for the toolkit they’ve used for centuries, which primarily recommends prudence. ‘Let’s wait it out’ is a common approach. We believe that is a lost opportunity.

With the treasure of data available and the resilience to recession that incumbents are known to have, they can invest in risk-aware initiatives that keep the engine warm to accelerate growth in the future. Operating model innovation, for example, can be transformative. Pathfinder teams can scout for opportunities, set the foundation and pave the way for new revenue and profit models.

Embracing the 4Ps — plan of action

To embrace the 4Ps model and set up the foundation for developing organizational plasticity, financial services players need the following.

Strategic clarity

Right operating model

Technology foundations

Data foundations

Strategic clarity

Strategic clarity drives the purpose-driven approach to embracing innovation. Whether launching new products or services, strategic clarity of purpose becomes the guiding light that helps organizations move towards the goal. For example, if precision banking is the strategic prerogative, technology teams will invest in building the data platform, machine learning models and products to meet that goal. Simultaneously, sales leaders will train their teams to embrace a relationship-driven model, strengthening on-ground customer interaction.

Right operating model

You can have all the clarity you want, but without a way to implement it on-ground, it can be useless. Therefore, this second pillar pushes organizations to have the right structure with alignment on goals and success metrics between leadership, business and technology. This ensures a smooth flow of information, decision-making and work, helping organizations respond faster to the changing market and customer needs.

Technology foundations

The biggest strength of an incumbent financial services organization is its scale. Delivering innovative solutions at scale needs a robust technology platform that is independently scalable, reusable and leverages evolutionary architecture principles. Not only should it power the experiments during the downturn, but also accelerate the rollout at scale when the time comes.

Data foundations

Last but certainly the most important competitive advantage of an incumbent financial services organization is data. This will be a key strategic asset in achieving organizational plasticity. Incumbents can dynamically leverage data to sense and probe the changing landscape, enabling decisions, identifying new opportunities, and testing new solutions.

At Thoughtworks, we’ve helped organizations take significant steps toward achieving organizational plasticity through our digital fluency, platform thinking, edge framework, engineering effectiveness and sustainable tech initiatives. Talk to us to see how you can make judicious investments in innovation to prepare for the impending upswing.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.