Financial Services 2025: How to Grow in the Challenging Years Ahead

Senior executives at two of the world’s largest asset management firms recently told us that the industry is filled with bloated enterprises...companies that are designed to move slowly, where good ideas die at the hands of local fiefdoms and bureaucratic decision-making. Their chief complaint? Slow and insufficient response to market changes.

Read part one in our four-part series exploring the future of financial services.

This is part one in a four-part series. Read Chapter 2 - Eight Strategic Forces That Are Transforming The Industry and Chapter 3 - 3 Core Principles to Unlock Growth.

How can the slow, bloated enterprise of today meet the fast-changing expectations of tomorrow’s customer?

The success of Target Date Funds (TDFs) can help us think about this problem. Launched in the mid-90s, TDFs have become the fastest growing retirement product category because they address what customers actually want—a simple solution to a complex asset allocation problem they don’t understand, and don’t want to understand.

Accelerating that trend, nimble competitors have subsequently launched robo-advisors and hybrid services that are highly transparent, easy to understand and very simple to use. Those firms have quickly won market share, including a sizable percentage of the new retail money entering the investment management market. This innovation cycle is far from over.

What do customers want?

Customers across generations, across the wealth spectrum, and across genders want to trust their financial partners.

They want to know that their bank or advisor has only their best interests in mind. They want clear, goals-oriented solutions, not sales tactics. They want their financial experience to be as intuitive, helpful, and rewarding as their social media experiences. They do not want to be worried about “being taken advantage of.” Above all, customers do not want to be “snowed in” by jargon, financial esoteria, and needless complexity.

Many customers simply do not believe that large traditional companies can actually offer what they want—highly transparent, personalized solutions that are aligned to their interests.

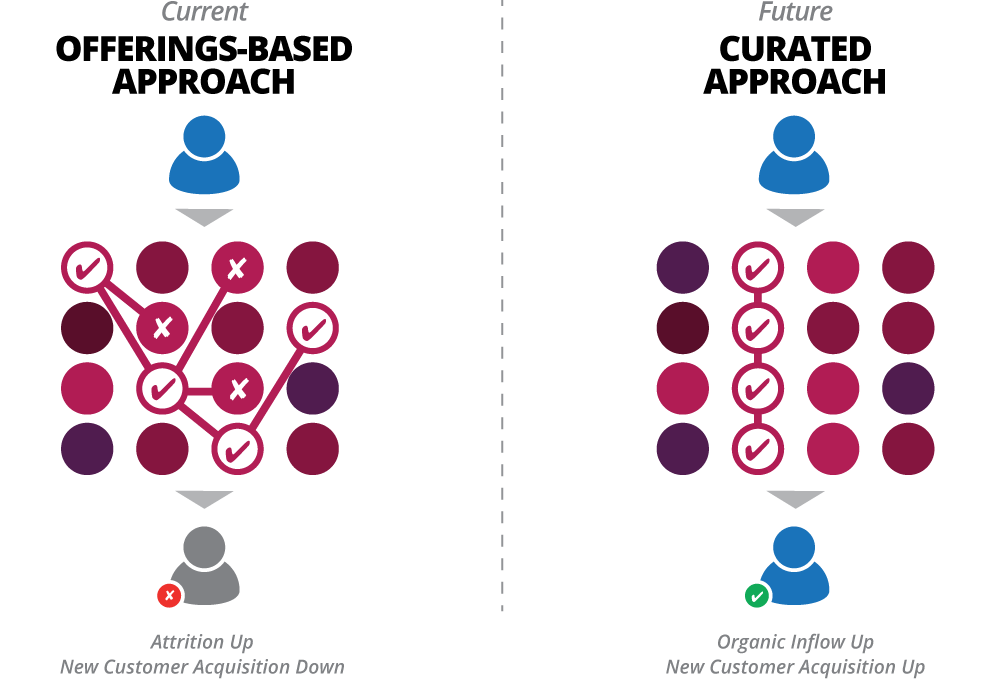

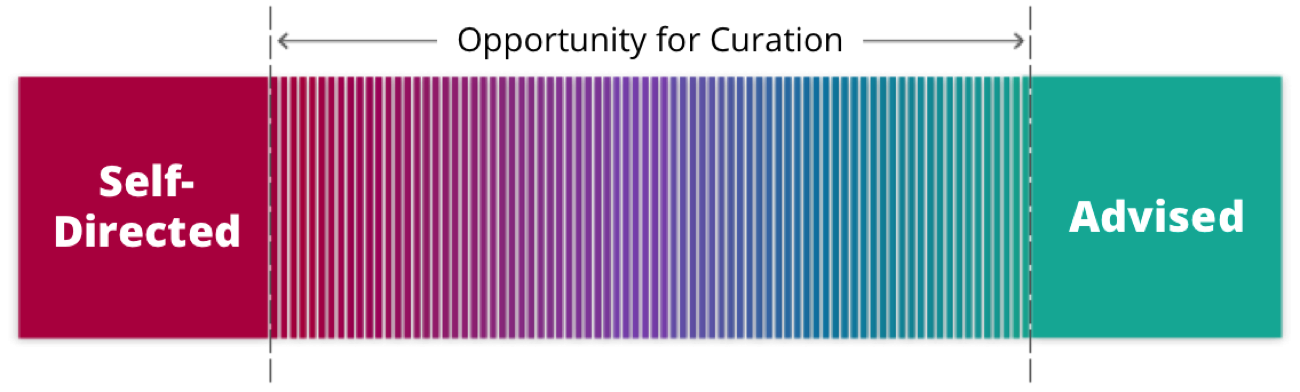

They believe they are being force fit into the industry’s model, which serves the industry’s interests. They must either self-direct their own decisions and face the consequences of their lack of expertise, or pay a premium to have an expert guide them through a thicket. Few traditional companies offer customers a highly curated way to serve their own needs clearly, simply, and transparently.

The gap between customers and the industry is still growing

These dynamics are well known by the industry, but only a few traditional companies have been willing to solve for customer value over internal conflict. The existing gap between what the customer needs and the current industry model is growing, not shrinking. But instead of responding to that gap, large banks are getting increasingly trapped by siloed complexity, reducing the timeliness and effectiveness of their efforts.

Is there a different lens to reframe these challenges so banks can find new ways to drive revenues, grow profits, and ensure longevity?

Most companies in the industry simply do not want to pressure their established business model and large distribution channel investments.

Banks are generally loath to compete with existing internal lines of business to attract new markets. As an example, banks have been slow to launch curated services that could compete too closely with advisors or their brokerage platform. Any customer-empowering curation channel is seen as undermining the value of the revenue-generating advisor instead of being viewed as a clear way to satisfy customers.

Here are two examples of leading companies who have found highly successful growth vehicles by creating new value in direct competition with other lines of business.

Vanguard launched its Personal Advisor Service (PAS) to offer a disruptively low priced, highly personalized, and heavily automated advice service for customers who did not meet the normal threshold to work with a human advisor (the industry average is $250,000 minimum in assets). By offering a human Certified Financial Planner (CFP) to help ask the right questions, and by offering an automated backend, PAS became the first true hybrid robo-advisor on the market. PAS quickly found a market with new customers as well as existing Vanguard customers, generating over $15 billion in organic new inflow in its first nine months. By offering a transparent service with low fees and and a human connection, PAS now supports more organic Assets Under Management (AUM) than the next four largest robo-advisors combined.

After building its custom investment management platform from the ground up, BlackRock could have chosen to leverage its Aladdin platform as a lightly differentiated source of competitive advantage. Instead, it decided to move into the software business by offering the Aladdin Platform as a subscription (SaaS) service as a full back end for 14,000 investment managers. This business now comprises over 5% of BlackRock’s total revenues, and acts as one of its fastest growing lines of business.

Regulatory requirements are a ready excuse.

Banks pay a very high complexity tax to comply with an overwhelming patchwork of regulations. But they compound this problem by solving for the letter of the policy instead of the intention behind the policy. This is an understandable over-reaction, given their need to reduce the threat of criminal or fiscal penalties. However, this defensive strategy has led to systemic inertia and a diversion of funds away from innovation on distribution channels.

In contrast, a number of leading financial services companies are achieving better compliance through automation-driven traceability and greater product simplicity. One of our clients automated the entire audit trail of changes to software, removing a major manual cost from their compliance spend. Creating new customer value based on transparency and clarity can no longer be a tradeoff for showing compliance.

So far, save for a few examples from established banks, only fintech start-ups have truly invested in the fast exploration of new business models, enhanced distribution channels, and anticipatory, highly-curated customer experiences.

Most traditional banks are instead investing incredible resources trying to drag new investors to existing service models. These companies are betting that tomorrow’s customer wants today’s offering, just with easier digital access. They are not ready to risk internal organizational resistance to align to a new set of customer expectations that can unlock growth. That is exactly the strategic mistake that led Kodak from industry dominance to irrelevance in the span of a decade.

Key takeaway:

Growth will belong to companies that can deliver new kinds of customer value, at start-up speed.

This is part one in a four-part series. Next: The Impact of Turbulent Strategic Forces.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.