Real-time payments and Open Banking are set to transform the way in which consumers interact with their finances in the next few years. This will bring the financial sector in line with the instant gratification expectations and data portability expectations set by other digital services in consumers' lives. The New Payments Platform (NPP) is key payments infrastructure in Australia that is supporting financial institutions and the broader ecosystem to make this transition. Its next platform service will enable customers to authorise third parties to make payments from their bank accounts, opening up new possibilities to manage payments digitally.

The opportunity the NPPA (New Payments Platform Australia) brought to Thoughtworks was to co-create, with Australia’s leading financial institutions, a set of Customer Experience (CX) guidelines that would help provide a degree of consistency in the user experience across financial institutions. This would normally be challenging, but a pandemic brought a new perspective in terms of how best to collaborate in a remote working environment.

The next step in NPPA’s roadmap

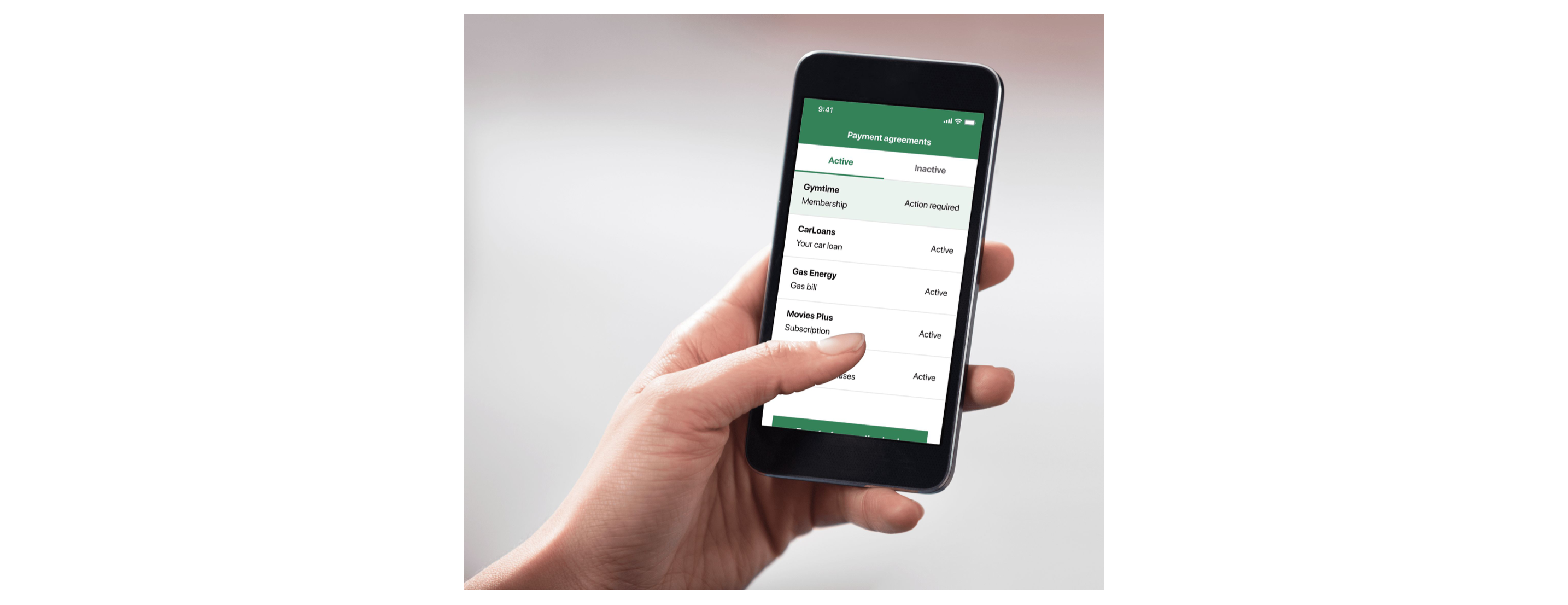

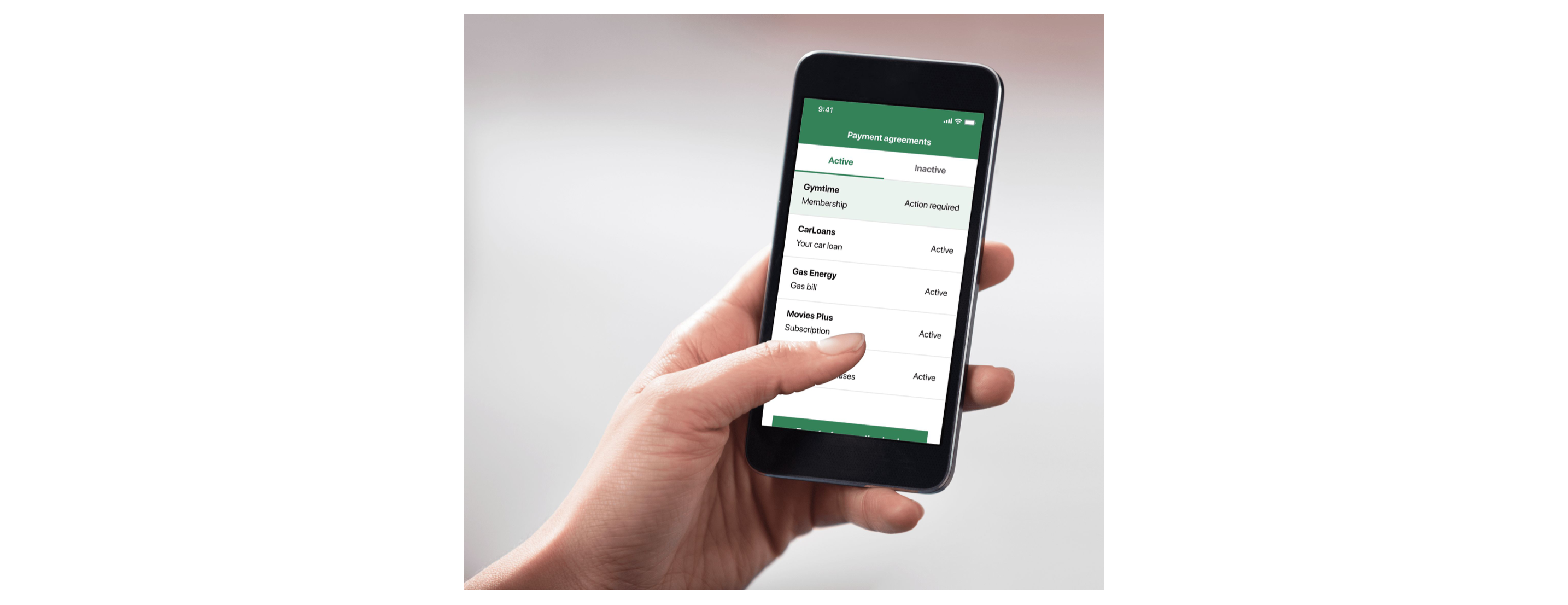

NPPA is responsible for maintaining and developing the payments infrastructure that enables Australian consumers, businesses and government agencies to make real-time, data-rich payments between bank accounts at participating financial institutions. After previously delivering the infrastructure behind Osko, the digital overlay service used in most bank apps to send real time payments using a PayID, the NPPA is now developing a Mandated Payments Service (MPS) [1], to enable customers to authorise third parties to initiate payments from their bank accounts. The MPS will essentially become a digital alternative to managing direct debit payments, support merchant-initiated transactions and in-app bank payments, and ‘on behalf of’ payment services offered by third parties, such as cloud accounting software providers and various fintech applications.

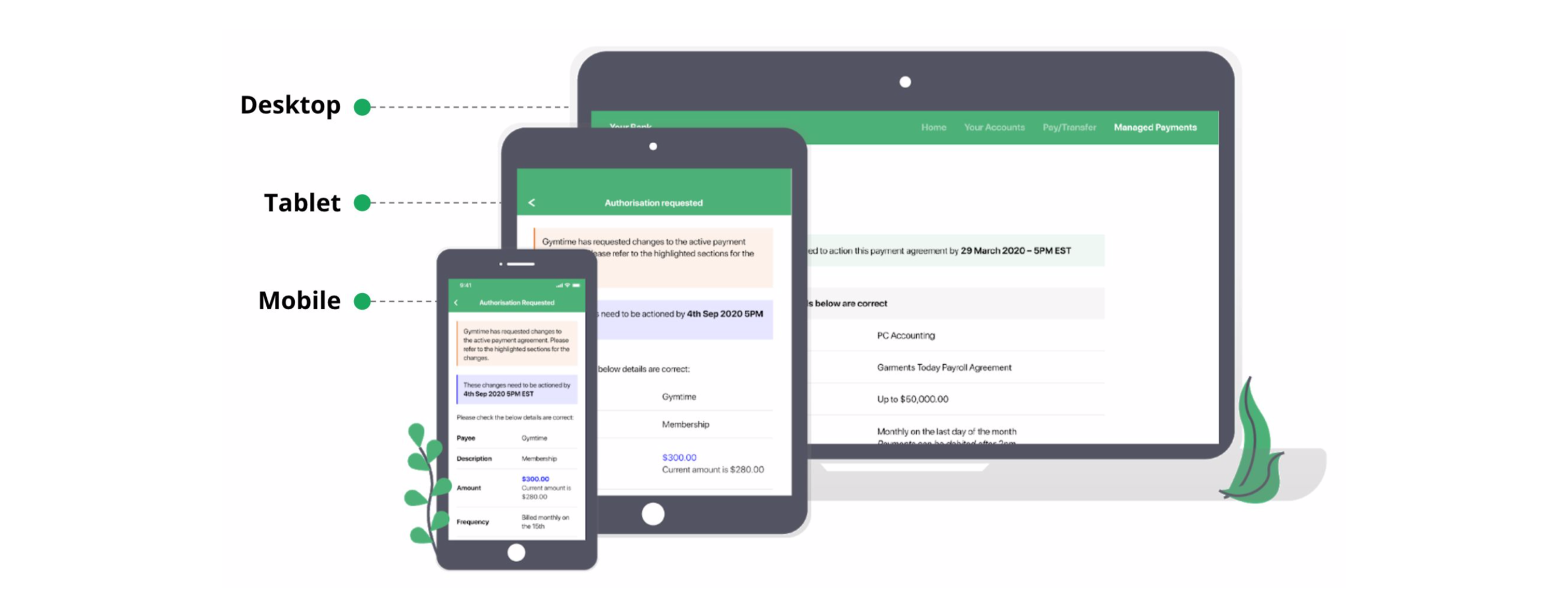

Thoughtworks was engaged to develop CX guidelines to support NPPA and their participating financial institutions; a cross section of Australia’s leading financial institutions who would be implementing the MPS capability within their mobile app and web channels. This was in response to feedback from those organisations that ensuring some consistency in the user experience would be an important element for the successful implementation of the MPS.

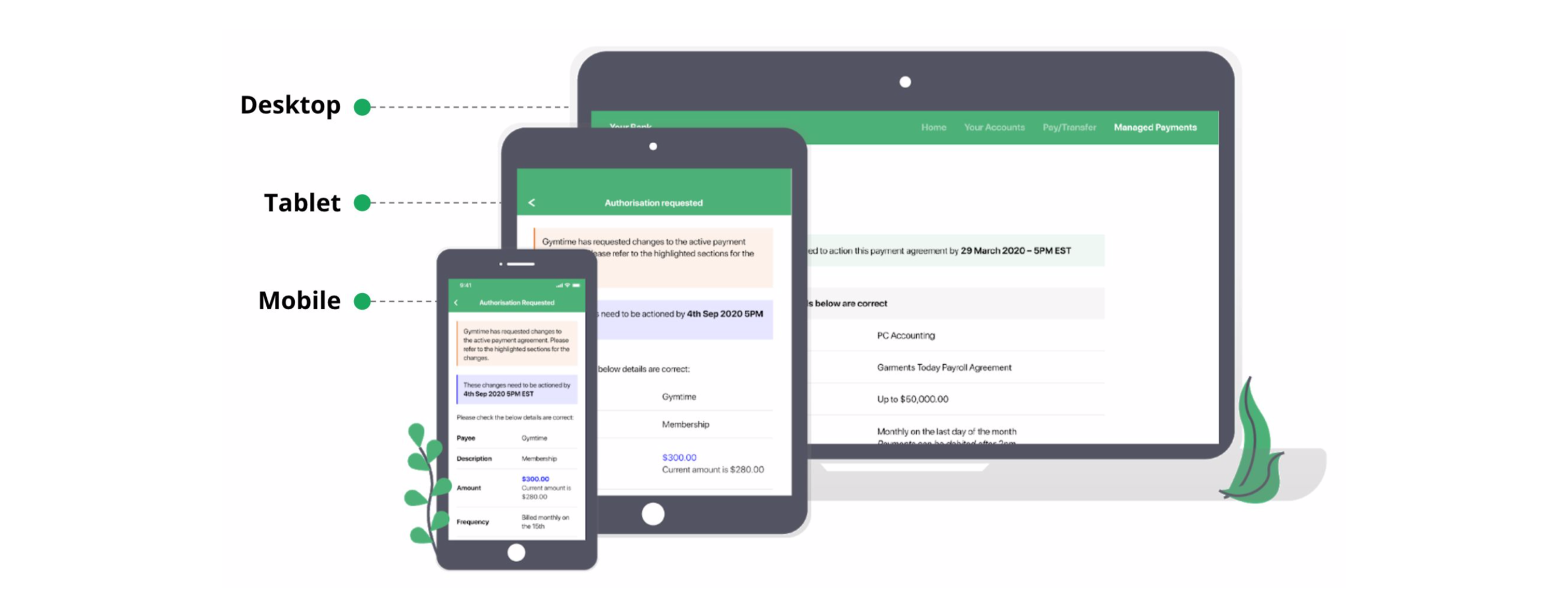

In addition, NPPA wanted to provide a user experience that increased customers' sense of control and visibility in managing their payments and allow them to make informed decisions when authorising third parties to initiate payments from their bank accounts. The CX guidelines had to strike a balance between ensuring consistency of the user experience in the areas where having some standardisation across financial institutions is important (such as data elements presented to the customer and consistent use of specific terms), while also providing flexibility for financial institutions to develop their own user experience for the MPS in line with their own brand, CX standards and other proprietary service related features.

The way forward

Thoughtworks was selected by NPPA based on proven experience supporting the development of CX guidelines for the Consumer Data Rights (CDR) legislation that enables Open Banking. Thoughtworks was also chosen for their extensive track record supporting Australian financial institutions to accelerate the adoption of innovative technology and supporting their teams to apply user experience principles in developing their products.

The team was initially engaged in May 2019 for six weeks to develop interactive prototypes, conduct user research and produce minimum user experience guidelines for participating financial institutions. This work was then extended upon in March 2020 over an additional 9 weeks, to incorporate enhancements to the solution design, the finalised CDR CX guidelines and feedback from financial institutions.

The Thoughtworks Team and output were first class, creating great engagement with our participating financial institutions, able to adapt to changing scope and showed what great remote working looks like.

Journey to delivering new CX guidelines

One of the major challenges of developing a B2B2C (Business-to-Business-to-Consumer) platform service like the NPPA’s MPS is getting engagement and feedback from the multiple organisations involved. Availability of participating financial institutions' digital teams would ordinarily be difficult due to how busy their schedules are, but this was further constrained by the onset of COVID-19 which put them on the front line for responding to customers’ banking needs. Relationship management and stakeholder logistics is something that is often underappreciated as a key skill when building a platform. However, NPPA with its core purpose of bringing the ecosystem together, leveraged their industry knowledge and experience to engage the financial institutions with Thoughtworks and conduct the multiple rounds of feedback necessary to ensure the CX guidelines would be a valuable resource.

With the onset of the COVID-19 pandemic, this forced all members of the Thoughtworks and NPPA team and financial institution employees to work from home. The blended team adopted an entirely distributed working approach, using a collection of real-time, multi-user digital collaboration tools. Thoughtworks’ tenured experience in distributed agile software delivery meant that the team of four designers and two business analysts located across Australia and China, aligned on direction and goals then split work on natural boundaries. This created autonomy for individuals or pairs to work efficiently, before coming back together to share progress and provide feedback.

Remote user testing did create a challenge, as although the team were able to recruit from both metropolitan and regional Australia, it proved difficult to gain access to less tech-savvy users and screened out those who were not familiar with PayID.

Delivering a new payments experience for customers

All of the above context was central to forming the team’s approach for developing the CX guidelines. Thoughtworks first facilitated workshops to ensure alignment with NPPA on the desired outcomes and then through multiple design sprints, applied an iterative approach to their development. This provided regular opportunities for participating financial institutions to engage at fortnightly online showcases, or offline using recordings and through collaboration tools, to give feedback on the evolving prototypes and guidelines.

When designing the user experience for the MPS, the team had to consider a number of factors. They first had to understand the technical constraints that had already been defined in the design of the service, so as not to design capabilities that could not be supported by the platform.

Consumers also bring their own mental models of how they interact with financial applications and their broader experience of other digital products. The team extensively reviewed design patterns of mobile and web apps that perform similar functions as input into each design sprint, in order to balance familiarity with innovation and to support ease of use.

The Consumer Data Rights (CDR) CX guidelines that underpin the implementation of Open Banking, will introduce new patterns that will become prevalent in the next few years. These patterns run counter to most frictionless e-commerce recommendations that intentionally accelerate users through the checkout process, but which are necessary when it comes to ensuring that customers are informed when authorising payments or consenting to give an organisation access to their data. The team therefore had to consider how to deliberately introduce friction for customers to take the time to review payment terms, without overly causing customer irritation that could impair completing the authorisation process.

The final factor was that the primary audience for the CX Guidelines would be the digital teams of participating financial institutions who might apply them in their own digital channels. The team therefore had to design a document that was easy to understand and follow, whilst also giving flexibility to apply their organisation’s brand, look and feel and provide scope for further innovation. The document also had to be easily maintainable for NPPA to incorporate any future amendments as the platform itself continues to evolve.

In order to define success outcomes with NPPA, and knowing that the outputs would potentially not be used by the participating financial institutions for between six months and a year whilst the service was being implemented, the team was careful to identify leading indicators that helped them measure progress within the short timeline of the engagement. These focused on usability measures from user testing the MPS prototypes, qualitative feedback from users on their experience of the service, amount of representation and feedback from the financial institutions in showcases as a proxy for engagement, and their final endorsement of the completed CX guidelines. Overall the final CX guidelines and prototypes were given very positive reviews from each of the key stakeholder groups.

What’s ahead

NPPA continues to innovate the platform and is exploring how best to support a range of third parties in being able to use the MPS.