Blockchain For Grown-Ups: Cutting Through the Hype

Every week you get an invitation to a blockchain conference. Every magazine and newspaper has an article about blockchain, and every company you talk to has an “innovation lab” working on blockchain. You’ve spent more than a few idle moments imagining the possibility and promise blockchain could bring to, well, just about anything! But then you go back to work and nothing has changed, and things are getting even more complicated than before—from regulations to customer expectations. If this feels too close to reality, then this series of articles is for you.

Installment #1: Cutting Through the Hype

The blockchain conference was an eye opener. Blockchain will revolutionize payments and digital rights management. It will provide iron-clad transparency over supply chain. It will disintermediate trade, reinstate trust in elections, put regulators out of a job. It will change the very definition of cash flows, companies and governments. As you ride home in a human-driven Lyft, you wonder how long until a self-driving, self-funding, self-maintaining vehicle will be driving you home. As the purple hue of the setting sun reflects off of the pristine glass and steel offices of all those financial institutions you pass by on the ride home, you wonder whether they are destined to look like abandoned auto plants in the Midwest, rendered inert by blockchain?

The morning after the night before, you’re more skeptical than enthusiastic. The same companies are still on top of the S&P 500. The Dollar, Euro and Renminbi are still the world’s reserve currencies. All that talk of “shared ledgers” sounds great but at the cost of making know-your-customer that much harder and money laundering that much easier. Ironically, to be a fully transparent ledger, we’d have to expose data we’re expected—even required—to keep confidential.

Which is it? Were the people at the conference harbingers of a new tomorrow or just the chattering class with too much caffeine? It’s intuitively appealing, but we need to be “realistic”—whatever “realistic” is.

Here’s a grown-up perspective.

While most implementations of blockchain come with a cryptocurrency for free, it’s important to remember that currencies are complicated. Currency values have to be relatively stable day-in and day-out if they’re going to be effective stores of value. If they are controlled by a central bank, the stability of their value is a function of the convenience of the bank itself; if they are traded freely, their values can fluctuate wildly. Where it’s easy to convert sovereign-backed currency into crypto-currency, governments will intervene to snuff out tax havens and prevent capital flight, particularly in times of economic stress. The current generation of crypto-currencies will remain a side-show until sovereign currencies become crypto-currencies as well—and that remains a long way off for the reserve currencies of the world.

“The transaction is the settlement” only if you are on a private blockchain where you know your counterparties well. In order for you to wash your hands of post-trade settlements on a public blockchain, you would have to stop caring about AML and KYC regulations just as they are starting to care about you. There will also be new intermediaries—companies that will exchange cryptocurrencies among blockchains, companies that will provide a wallet, the ability to make payments, the ability to take loans and the ability to make investments. Most people—indeed, most regulators—would call the provider of those services a bank. Besides, cash will be with us for a long, long time to come.

“The transaction is the settlement” only if you are on a private blockchain where you know your counterparties well. In order for you to wash your hands of post-trade settlements on a public blockchain, you would have to stop caring about AML and KYC regulations just as they are starting to care about you. There will also be new intermediaries—companies that will exchange cryptocurrencies among blockchains, companies that will provide a wallet, the ability to make payments, the ability to take loans and the ability to make investments. Most people—indeed, most regulators—would call the provider of those services a bank. Besides, cash will be with us for a long, long time to come.

Ten minutes of Googling will turn up at least five different implementations of laundering money on blockchain using a method called tumbling. It goes to show that exposing transactions is not the same as exposing counterparties or counterparty risk. Fraud can hide in plain sight. While there are ways to prevent this, especially in custodial and private blockchains, there is no inherent protection from fraud with a blockchain.

Most people write down their passwords on stickies attached to their computers. How can we expect those people to manage lengthy, cumbersome private keys? Since a lost phone is still an everyday occurrence, having apps remember keys is a surefire way to have your Bitcoin wallet cleaned out. Because there is still no safe, simple mechanism for verifying users at the endpoints today, we’re relying on a leap of faith to provide trust in this system.

Wealth and income disparity have more to do with power disparity than a new fangled database. Public blockchains like Bitcoin are amended by network nodes competing for cryptocurrency rewards to solve math problems in an arrangement called “proof-of-work”. This incentivizes a computing power arms race among miners. No matter how clever their algorithms, the winners will be those with the most capital to invest in computing power. Proof-of-stake systems just cement unequal distribution of power with a strong advantage to whoever created it. All forms of explicit, concentrated power are susceptible to compromise or corruption.

At first glance, blockchain looks like it will change the world. Stare at it longer and it seems that all there is to it is hype.

Tweet this

Tweet this

But neither is entirely true. Although it has far more potential than practical use today, it does provide a new way of thinking about problems and that deserves serious consideration today. Blockchain makes it easy to create a shared, distributed database that’s simple for any possessor to append to but nearly impossible to fraudulently change, making it particularly suitable as a “registry of truths”.

In this series we aim to help you look at business problems through a blockchain lens as you look to create value for your customers and shareholders. In the next installment, look more closely at possible and practical uses for blockchain today. Read Part Two: What's Real?

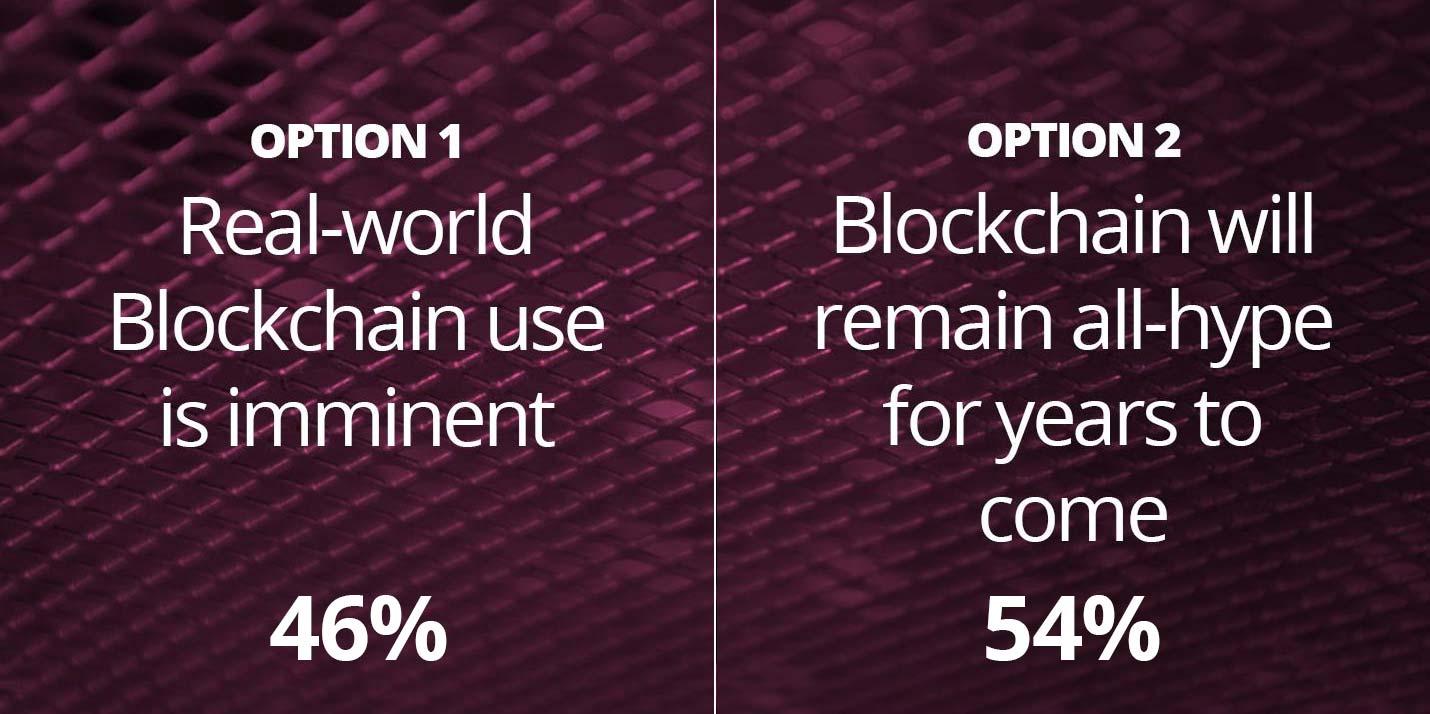

Update: Here are the results from a recent poll by readers of this article

Aviso legal: Las declaraciones y opiniones expresadas en este artículo son las del autor/a o autores y no reflejan necesariamente las posiciones de Thoughtworks.