Nimble, uno de los primeros prestamistas disruptivos de Australia, tiene la visión de agilizar el financiamiento. En el último año, Gavin Slater, consejero delegado de la empresa, ha dado un giro significativo a su visión y ha tratado de transformar la empresa, que ya no se dedica a los préstamos a corto plazo, en una tecnología financiera realmente centrada en el cliente.

La transformación nunca es fácil, sobre todo a la velocidad necesaria para competir en el próspero ecosistema de las empresas financieras australianas. Thoughtworks se asoció con Nimble durante un periodo de siete meses para proporcionar la coordinación de la entrega del producto y la excelencia técnica para crear un nuevo producto de crédito, Nimble AnyTime.

Un sector fintech en rápida evolución

La velocidad y la innovación siempre han estado a la vanguardia de la estrategia de Nimble. Fue la primera en sacar al mercado aplicaciones sin papel en 2009 y Straight-Through Processing (STP) en 2011. Sin embargo, como ocurre con muchas startups de éxito, el crecimiento no se ha producido sin acumular deuda técnica, lo que ha obstaculizado la oportunidad de seguir innovando y escalando.

Paralelamente, en los dos últimos años Australia ha sido testigo de una enorme fragmentación de los servicios financieros con el auge de las Loantech especializadas, las Fintech y los Neobanks. Estos nuevos operadores han potenciado el sector, ofreciendo a los clientes comodidad y rapidez para interactuar digitalmente y acceder a servicios adaptados a sus necesidades. Esto no ha hecho sino amplificar las crecientes expectativas de los clientes, cada vez más exigentes con otros servicios digitales, de que todo sea instantáneo, fácil y personalizado.

Con una marca, una base de clientes y un conjunto de datos crediticios sólidos, Nimble necesitaba hacer honor a su nombre y responder con rapidez, al tiempo que se aseguraba de estar haciendo lo correcto para sus clientes. En 2019, la empresa se propuso hacer realidad su visión de abandonar los préstamos de día de pago. En su lugar, Nimble ampliaría su experiencia en la toma de decisiones crediticias y pivotaría para ofrecer nuevos productos a un público de clientes casi de primera categoría, conocedores de la tecnología digital y decepcionados por los prestamistas tradicionales.

El camino a seguir pasa por colaborar en lugar de crear

Con el fin de actuar con rapidez y garantizar que Nimble se centrara en su actividad principal, en lugar de intentar construir y poseer toda la pila de soluciones -una estrategia que suele sumir a las grandes empresas en años de entregas infructuosas-, seleccionaron alternativamente socios de productos y plataformas con los que colaborar.

Nimble eligió Mambu para su libro mayor; Illion para los datos bancarios, eKYC y la comprobación de fraude/crédito; EML para su motor de pagos con tarjeta de crédito; SplitPayments para la pasarela de pagos en tiempo real; AWS para la infraestructura en la nube. Por nombrar algunas de las muchas integraciones, cada una se seleccionó sopesando la idoneidad y utilidad del servicio, la experiencia del desarrollador y la modularidad.

La diferenciación se conseguiría integrando estrechamente estos servicios y ofreciendo al cliente una experiencia sin fisuras que estuviera a la altura de la promesa de marca de Nimble.

Ante todo, Nimble necesitaba un socio con un historial probado y cuyo compromiso con el cliente y la excelencia en la entrega coincidiera con el nuestro. Al elegir a Thoughtworks, encontramos un socio que aportaba flexibilidad, capacidad y madurez no solo para ayudarnos a alcanzar nuestros objetivos, sino que también se comprometía a desarrollar y alimentar la incipiente transformación de Nimble en una Fintech contemporánea orientada al producto".

El camino hacia un gran producto digital

Para lanzar con éxito un producto digital es fundamental contar con el equipo adecuado para ofrecer la solución. Thoughtworks ayudó a Nimble a desarrollar su propia capacidad para la futura evolución continua del producto.

Para alinearse en torno a un propósito y un objetivo comunes para el nuevo producto de Nimble, Thoughtworks facilitó en primer lugar un taller inicial con el equipo directivo y de entrega del producto. Esto ayudó a exponer las diferencias de entendimiento y a desarrollar un plan ligero que pudiera actualizarse a medida que el proyecto avanzaba y se comprendían mejor las limitaciones.

Inicialmente se optó por un planteamiento "hilo de acero" de extremo a extremo para garantizar que la funcionalidad expuesta en la aplicación se integrara con los servicios subyacentes. Sin embargo, esto puede plantear dificultades cuando no siempre es fácil mostrar los avances y obtener comentarios de las partes interesadas, por lo que el equipo se flexibilizó entre el desarrollo de interfaces frontales y su posterior integración.

Con muchas integraciones de socios y tecnologías nuevas para Nimble, el reto de coordinar una colaboración eficaz para entregar a tiempo era clave. Aunque en un mundo ideal todos los servicios cuentan con API bien documentadas y entornos de prueba, en la realidad se requiere que los equipos sean flexibles y se adapten, tomando decisiones rápidamente que permitan avanzar y que puedan revisarse más tarde, cuando los socios puedan responder.

Aplicación del aprendizaje automático a la concesión de créditos

Un factor clave de la promesa de marca de Nimble de "hacer que las finanzas sean más rápidas" es la adopción e implementación de una capacidad industrializada de aprendizaje automático. Entendiendo las complejidades y preocupaciones comúnmente asociadas con tales esfuerzos, Thoughtworks trabajó con Nimble en el desarrollo de una infraestructura de aprendizaje automático que, de una manera medible y observable, libera el valor de los ciclos de experimentación rápida. Las iteraciones de los modelos se entrenan, validan y, una vez que se demuestra que son mejores, se promueven a través de la tubería de Entrega Continua para el Aprendizaje Automático (CD4ML) de Nimble hasta la producción.

El primero de estos modelos, "Olas", de la palabra gaélica irlandesa para "conocimiento" ("Eolas"), ayuda en el proceso automatizado de toma de decisiones impulsando la eficiencia a través del procesamiento directo (STP), lo que permite a Nimble procesar las solicitudes de préstamos al ritmo de la cambiante economía australiana. La iniciativa del programa, titulada 'Continuous Credit Intelligence (CCI)' -iniciada a finales de 2019 para apoyar la iniciativa de la plataforma AnyTime de Nimble- es ambiciosa y, con una base sólida en CD4ML, Nimble confía en impulsar el valor futuro del cliente y del negocio a través de la aplicación y optimización continuas del aprendizaje automático.

Introduciendo 'Nimble AnyTime'

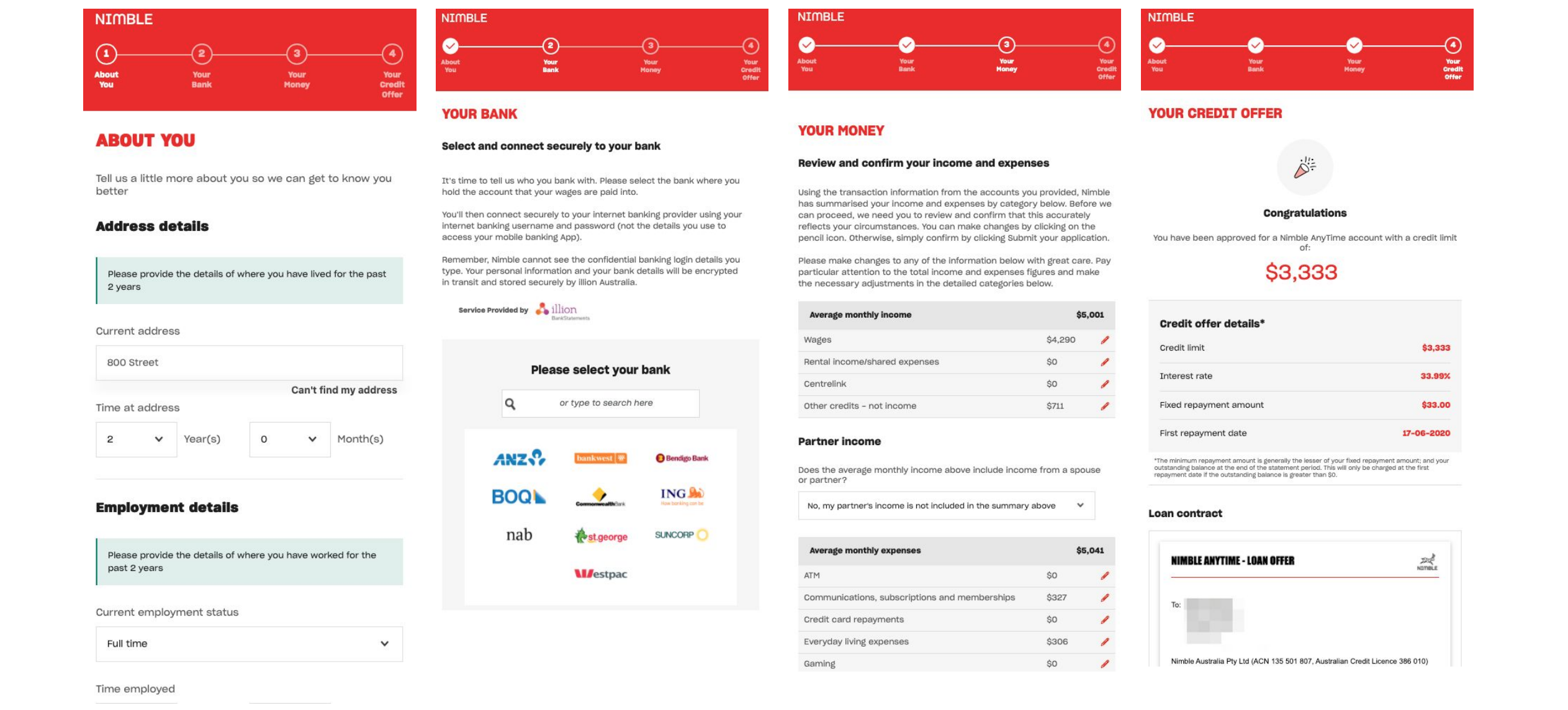

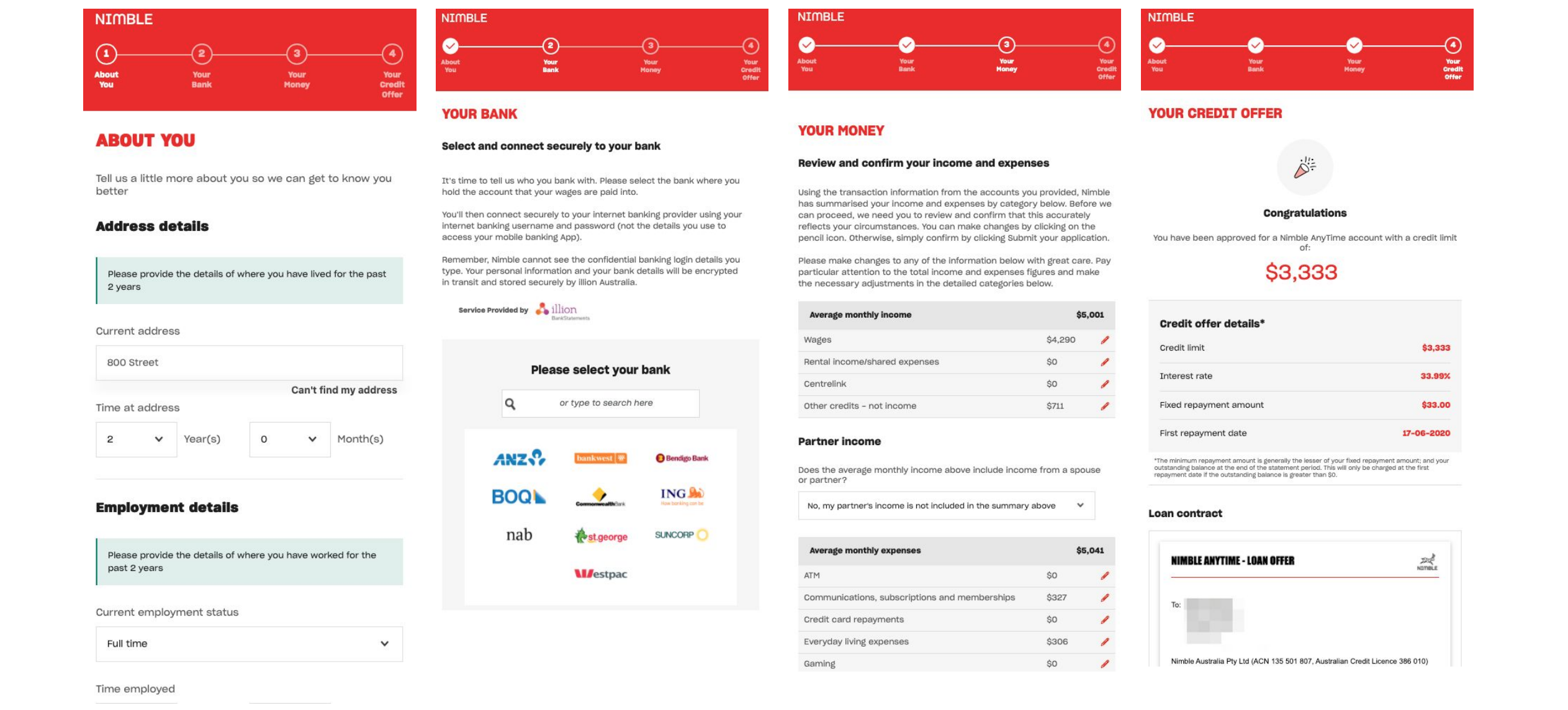

Después de siete meses, se lanzó una versión beta de Nimble AnyTime a un segmento de clientes existente para validarla y optimizarla antes de lanzarla a una base de clientes más amplia. El producto ofrece una línea de crédito de hasta 10.000 dólares, a la que se accede a través de una tarjeta virtual Nimble en su monedero Google Pay o Apple Pay, con reembolsos de importe fijo a lo largo de 12 meses. Los clientes ya pueden obtener la aprobación de los préstamos y estar listos para "tocar y listo" en cuestión de minutos una vez que descarguen la aplicación de la tarjeta de crédito Nimble. La aplicación enlaza directamente con la cuenta Nimble del cliente, lo que permite disponer de los fondos aprobados para gastarlos en el momento.

El canal de solicitud e incorporación incluye la verificación automática de la identidad mediante el carné de conducir del cliente, la categorización automática de ingresos y gastos a partir de la integración de transacciones bancarias para garantizar la capacidad de servicio, y el procesamiento directo y la toma de decisiones sobre los límites de crédito aprobados.

Lo que se avecina

Nimble y Thoughtworks están estudiando actualmente cómo aprovechar su capacidad de aprendizaje automático para la toma de decisiones crediticias y ofrecerla como servicio a otras empresas del ecosistema de las tecnologías financieras.